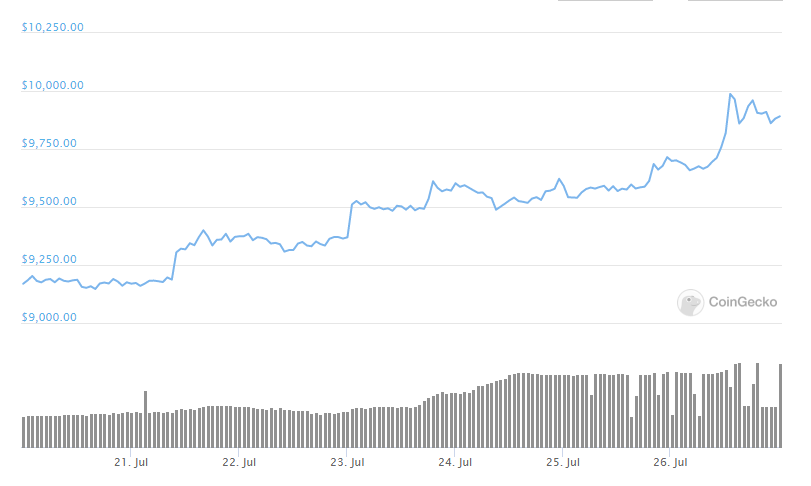

Bitcoin Liquidated $75 million worth of short contracts and the price instantly surged to $10,200 which got many analysts wondering, what exactly happened here?

Well in today’s BTC news we can see that the price increased to a high of $10,272 in an unexpected weekend rally and Bitcoin liquidated $75 million worth of long contracts on BitMEX only. This could be the main reason behind the sudden surge over $10,000 but the liquidation of over-leveraged shorts and taking profits from the users could also be considered as a second reason. When the price started surging, major altcoins as DeFi tokens started slumping.

Ethereum dropped from $322 to $311 and other Defi tokens such as Aave and YFI saw huge rejections. The rejections of major altcoins and the price surge of BTC only suggest that traders took profit from the recent altcoin rallies and traders moved their altcoin gains to BTC to start a BTC uptrend while other altcoins dropped.

Ethereum’s ETH for example increased from $247 to $322 in one day, recording a 30% gain and despite the sentiment around altcoins currently, investors are taking a more cautious approach by hedging other gains. When Bitcoin broke over $10,000, it triggered the short-contracts and became liquidated and BTC reached $10,200 which also caused a huge liquidation to occur totaling $74 million. BTC could see phases when more than $50 million short or long contracts get liquidated but this is less likely to happen.

The huge liquidations of long contracts suggest that this level remains a heavy resistance area but as soon as BTC hits $10,200, the price dropped below $10,000 which marked a short-lived rally. The price of BTC recovered strongly in recent weeks and some industry executives and investors seem quite optimistic towards both ETH and BTC. Popular trader Peter Brandt expects the price of BTC to hit a new high:

“That is actually where my head is. Massive symmetrical triangle in $BTC points to ATHs, then $50k.”

Some however could affect the short-term price trend of BTC as the funding rate is projected to be over 0.04% on BitMEX. This is about four times higher than the average funding rate set at $0.01 which signifies that most of the market is taking long positions. ,000 acted as a key psychological level for BTC and if it rejects it, it will be lower than the previous peak in February this year.

buy silagra online https://www.illustrateddailynews.com/wp-content/themes/twentytwentytwo/parts/new/silagra.html no prescription

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post