Bitcoin is worth half of all of the mined silver in the world as of today, with a market cap of almost $780 billion. Following our latest BTC news, we are taking a closer look at the data.

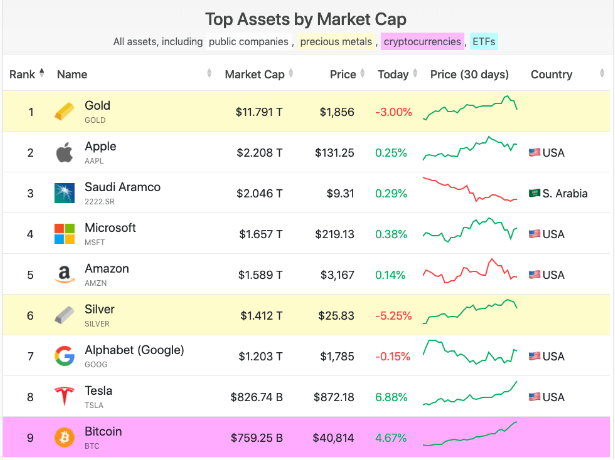

According to the data from Infinite Market Cap, Bitcoin is worth half of all of the mined silver today, surpassing tech giants Tencent, Alibaba, and Facebook in terms of market cap as well as Warren Buffett’s Berkshire Hathaway. Bitcoin’s latest rally pushed the price past $40,000, reaching a new high but with the world now being focused on the rising prices, Bitcoin’s increasing market cap went unnoticed. With a market cap of almost $780 billion, BTC is the ninth-biggest asset in the world.

#Bitcoin has surpassed Facebook $FB in market cap. Makes sense that a money network would be more valuable than a social network. pic.twitter.com/XofI9W0Mce

— Cameron Winklevoss (@cameron) January 8, 2021

BTC shortly surpassed Facebook’s market cap that is $755 billion which makes it the tenth biggest asset and sixth biggest tech company in the world. Chinese tech company Tencent also ranks below Bitcoin with a market cap of $706 billion while the global e-commerce giant Alibaba ranked 12th with a market cap of $629 billion. BTC outperformed Berkshire Hathaway which is the world’s biggest holding and investment company that was founded by Warren Buffett and according to the data from Infinite Market Cap, Berkshire Hathaway is the thirteen-biggest asset with a market cap of $547 billion.

While it will take plenty of bull runs to push bitcoin above gold, the growing market cap became even more impressive once compared with the Silver. With a current market cap, Bitcoin is worth half of all the silver in the world where 1.7 million metric tons of silver have been mined until today, at a price of $26 per ounce, which puts its market cap at around $1.43 trillion. Even given the fact that the market cap calculation doesn’t take into account the amount of silver that was lost or destroyed, the number of BTC that vanished forever is not taken into account as well so the data only strengthens the case for BTC on the market. This means that once BTC reaches a price of $80,000, its market cap will be larger than the current market cap of the silver.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post