Bitcoin indicators flash buy signals but the bottom could still be located at $20K as analysts warn so let’s read more today in our latest Bitcoin news.

Every BTC investor is searching for signals that the market is approaching a bottom but the price action of the week suggested that we are not there yet. The evidence of this can be found by looking at the monthly returns for BTC which was hit with a strong decline and became one of the biggest drawdowns in monthly returns for the asset class as per the most recent Blockware Solutions Market Intelligence Newsletter. Bitcoin indicators flash buy signals but the coin continues to trade within an increasingly narrow trading range which is being compressed to the downside with the global economic strains mounting.

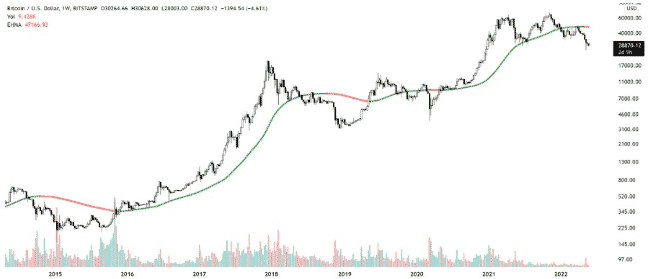

Whether the price continues to trend lower is a popular topic of debate among crypto analysts and the main opinion points to further downside. The analysts will stay bearish until $45,000 is reclaimed. There are also plenty of indicators that point to a bearish outlook as long as the BTC trades below the $45,000 or $47,000. this includes the fact that BTC started off this year in the $46,200 range while the 180-week exponential moving average indicated that the moment for BTC is dropping and now sits at $46,166.

The short-term holders were hit hard by the market weakness with the short-term holder’s cost basis sitting at $45,038. If you take this together, the data points suggest the sentiment for BTC remains bearish as long as the price remains under $45,000. despite the current gloomy analysis, there are a few signs that the market could be in the process of looking for a bottom. According to the recent Glassnode reports, after the early May drop below $30,000 for BTC, the network activity increased with more supply changing hands while the network shed more value. Glassnode reported:

“This phenomenon has historically signaled a great buying opportunity.”

The support the claim that BTC is now in a good buy zone, the report pointed to the entity-adjusted dormancy flow that was consolidating within the area which was considered an optimal purchase zone. Blockware Solutions saw a few data points which suggest that the market cap is in search of a bottom. While multiple data points confirmed that the crypto marekt is in a bearish state, there are some indicators that the seller’s exhaustion could be reaching its limit.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post