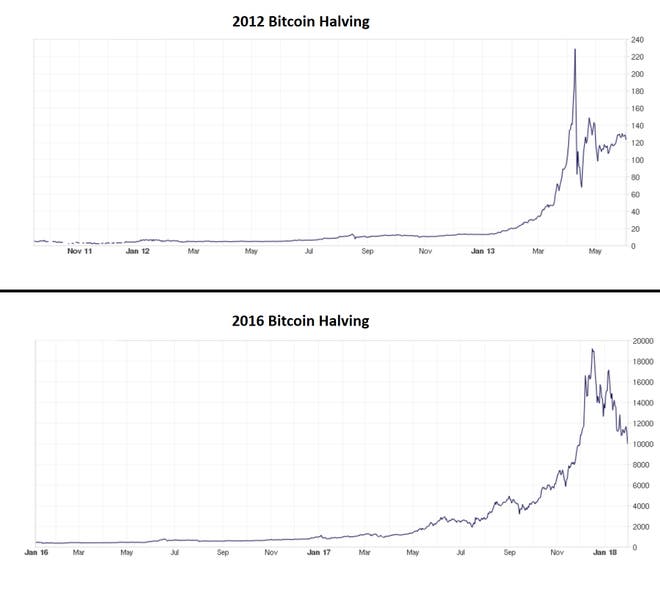

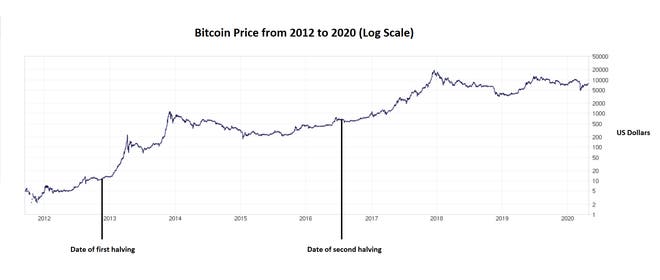

The Bitcoin halving history shows that the cryptocurrency could grow by 100% this year. Back in 2017, the BTC price reached an all-time high level of $20,000 but 17 months before that, the cryptocurrency underwent an event called halving which some analysts believe that it has a huge impact on the market so let’s find out more about it in the following Bitcoin latest news.

Bitcoin is a week away from the next halving and some of the analysts say again that another rally is about to happen. This time, the bull run could start something unseen before. The CEO of the British-based cryptocurrency exchange CoinCorner Danny Scott told the Independent:

“Many eyes have been on bitcoin since 2017, with people eagerly awaiting its next big moment. We believe that moment is coming and we can expect to see an explosive year for bitcoin.”

The price predictions for the upcoming months are complicated because of the ongoing coronavirus pandemic which brought havoc on the entire economy. There were major crashes in prices for Bitcoin in March since people wanted to liquidate their assets though it performed well compared to other fiat currencies and commodities. The Bitcoin price is volatile so the short-term losses or gains are expected even under the given circumstances. With the halving, the 18,375,000th block will be generated and will trigger a shift in the mathematical code within the cryptocurrency.

The miners’ rewards producing BTC will be cut in half and it will become twice as hard to produce new units of the coin. This is the third time that a halving has happened and the next one will happen in four years. By cutting the supply in half, inflation is prevented. According to the Bitcoin halving history, the effect will be that most of the miners will turn off their machines and shut down operations since it will not be profitable to mine.

Some analysts believe that this could cause the price to crash. For example, the COO of Bitcoin ATM network Digital Mint Don Wyper explained:

“What if some miners keep selling BTC to pay for overhead, holding out for said difficulty adjustment, increasing supply, an Don d putting significant downward price pressure on the market? That being said, after the previous ‘halvenings,’ the price of bitcoin skyrocketed, so my opinion is that long term bitcoin is currently undervalued.’’

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post