Bitcoin got rejected at $23K with over $200 million liquidated on a daily scale with the entire market being covered in red again so let’s read more today in our latest Bitcoin news.

Bitcoin failed at $32,000 and brought all altcoins along which resulted in another market-wide retracement so the liquidations and the number of liquidated traders surged. Yesterday was a positive day for the crypto market with BTC leading the day after a surge to $32,000 and the altcoins experienced some notable increases with Cardano and Solana leading the way.

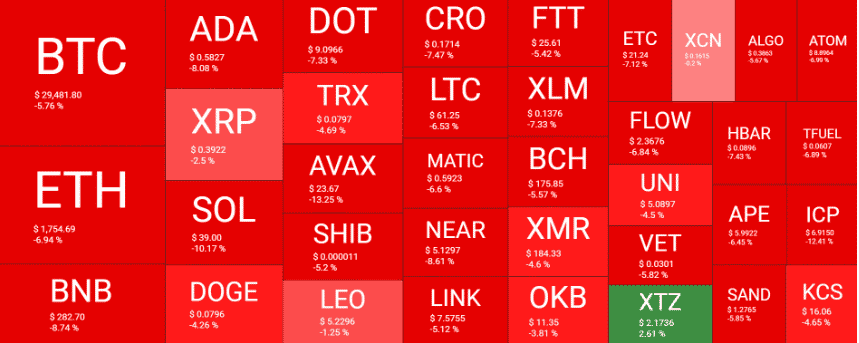

As it has happened a few times in the past few weeks, it turned out to be a false breakout and instead of going north, BTC crashes by $3000 in a few hours and dropped all the way to $29,000. the altcoins are not doing much better either with SOL, ADA, AVAX, and BNV losing double-digit percentages in one day.

The cumulative market cap of all crypto assets is down by $90 billion in one day to over $1.2 trillion. The data shows Bitcoin got rejected at $23K and the enhanced volatility liquidated about 80,000 traders in the past day with the total value of wrecked positions being well over $200 million.

As recently reported, Bitcoin stayed in a tight range as traders’ demands for a new low persisted and the data shwoed that the BTC/USD remained stuck below $29,000 and $30,000 into the weekend. The pair managed a revival to $31,000 but the last Wall Street trading session put pay to the bull’s efforts. The “out-of-hours” markets offered some thin volumes but almost no volatility as the eyes were on the potential direction of what would be an inevitable breakout.

Despite the sell-off, BTC hasn’t broken below any major trendline and it is trading above the on-chain cost basis of $24,000 and its 200-week moving average. The BTC network absorbed the Terra selloff and it seems to be behind it now as it hasn’t broken any major trendline levels. About 66% of the BTC supply hasn’t moved in over a year which only confirms the market’s long-term focus and the holder base that has a stronger conviction.

The price of PancakeSwap surges 9% after binance revealed a strategic investment in the platform and now CAKe skyrocketed by about 9% as the exchange revealed a strategic investment in the decentralized exchange. PancakeSwap is a veteran and leading DX on the BNB chain and now has been in terms of overall trading volume since the launch.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post