The Bitcoin exchange balances get low as Bitcoin withdrawals still resume in the first month of the year as we can see more in our latest Bitcoin news today.

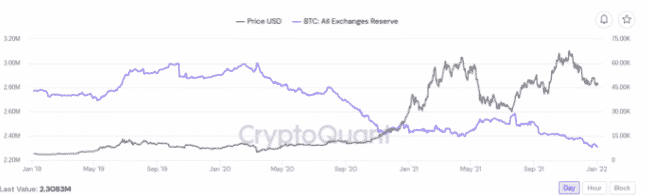

The Bitcoin exchange balances are back to their record lows as 2022 enhanced its appetite among buyers. The data from on-chain analytics company CryptoQuant shows the reserves across 21 exchanges are set at 2.308 million BTC as of January. The exchanges return to overall BTC balance downtrends. In late December there was a macro low of 2.303 million BTC left on exchanges before a slight increase to 2.334 million. As the institutional entities returned to the market after the holiday period, the downtrend resumed in line with the expectations that larger-volume buyers will have to step in in the first quarter.

If you leave out exchanges it skews the results. Leaving out eg. Huobi has a huge impact because of the China spot trading ban.https://t.co/knyoF702kW

— Root 🥕 (@therationalroot) January 3, 2022

The exchange balance data is a topic of some debate now as the statistics show varying numbers of exchanges and wallets that result in data that is barely comparable. CryptoQuant’s 21 exchanges compete with the 18 others monitored by Glassnode and the 5 by CoinMetrics. Cryptorank on the other hand put the balance at 1.3 million BTC on Christmas Eve. Depending on the platforms, the trend could also be different as some exchanges saw an overall reduction in their balance over the past month while the others saw an increase. This was the case with Huobi Global that was obliged to deregister in China by the end of 2021 because of the regulations. Analyst David Puell who created the Puell-Multiple indicator revealed his thoughts on the upcoming market participant behavior.

The relaxed nature of BTC in 2021 against the one in 2019 kept the retail investors and their FOMO away and the analyst said that this is healthy in the long-term. He noted:

“The market is mostly going to be owned by institutional players, especially in month-to-month price movements, with some profit-taking from early adopters but a much more diminished role coming from retail players.”

As recently reported, Hong Kong’s Bitcoin Association was the first to celebrate the Genesis Day as the Asian markets started trading in the first week of 2022. The Association added that it will be a good time to make sure that all of your bitcoins are in a wallet that you control in terms of private and public keys. The date is also known as the Proof of Keys celebration as BTC pioneer Trace Mayer suggested. The proof of keys website celebrates the annual event encouraging Bitcoin holders to take control of their assets.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post