Bitcoin enters golden accumulation zone after the recent 20% crash according to analysts and this could be the first time for the traders to refill their stash as the asset is trading close to the multi-week low levels. In our latest bitcoin news today, we are reading more about the price analysis.

The charts show that bitcoin enters golden accumulation zone as per the fundamental and technical catalysts that could boost the cryptocurrency price higher. The BTC/USD pair is trading below the purchasing price which means most of the traders will be selling their coins at a loss which will lead to a decrease in supply. It could also increase the bids for the cryptocurrency at the demand side which comes after the pair plunged by more than 20% from the year-to-date high of $12,486. The downside correction came after the 200 percent rally hinting that traders locked their profits at the local tops. The bearish move coincided with the drop across the gold markets as well as the stocks.

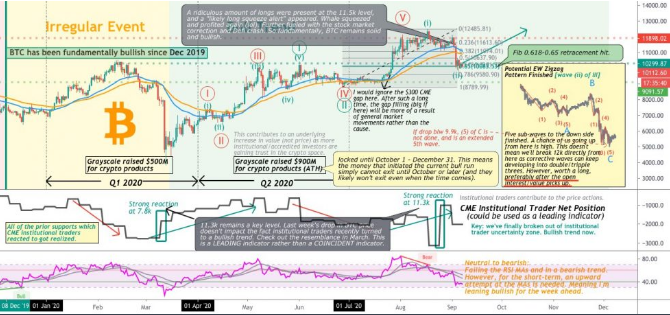

Many observers feared that BTC/USD will extend its downside momentum to $9,600 or the levels below but the pair managed to secure the base above $10,000 which is the previous resistance level that acts as a support. Phi backed the bullish bias with stable institutional and miner activity on the market. The portal explained that $900 million Grayscale Invesemtns raised in Q2 will not be available for exiting until October 1st. Phi continued:

“With miner capitulation historically marking market bottoms, this is a bullish long-term sign.”

The portal added that the Bitcoin futures market is repeating the 2020 fractal as there were ridiculous amounts of long positions at $7800 which led to a Long Squeeze. The bulls had a similar exposition to $11,300 which is a level that pushed them to the wrong trade end:

“Currently, the margin market is overly bearish, but not enough people are on board with the “bearishness” so we do need the open interest to pick up a bit to fuel an ideal short squeeze. As for the CME institutional traders’ positions, last week’s drop doesn’t impact this group turning bullish after 3 months of indecisiveness.”

Phi reminded the traders of the long-term impacts of inflation on the market as the portal said that the Federal Reserve’s commitment to raising inflation beyond the 2 percent will keep investors glued to Bitcoin for hedging characteristics:

“This will fundamentally push up the value of gold, bringing up bitcoinalong the way as the main value proposition of bitcoin remains a store of value rather than remittance.”

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post