Bitcoin ended the week on the edge as the S&P 500 got into a bear market, down 20% from its latest peak, which is a warning sign for the risk assets anywhere so let’s read more today in our latest Bitcoin news.

Bitcoin struggled to recover its losses after the Wall Street trading provided almost no respite. Bitcoin’s price reflected the stock performance as well. The data shows that BTC/USD trading dipping below $28,000 into the weekend and added another $500. Down by 4.7% from the previous high of $30,000, the pair looked in the range when the US Stock indexes saw a volatile trading day in the week. The S&P 500 managed to reverse after falling at the open but it also confirmed the bear market tendencies which traded at 20% below the high last year. A Twitter account Blockchain Backers commented:

“Another wacky day in the stock market. Dow Jones -500 early in the day, then recovers it all and closes +8. Bitcoin still just teetering on the edge.”

The S&P 500 has officially entered a bear market pic.twitter.com/N1lrcBdziT

— Fintwit (@fintwit_news) May 20, 2022

Bitcoin ended the week on the edge and many sources called for BTC to fall again in a manner quite similar to the capitulation event from last week. Continuing with the conservative macro outlook, Twitter commentator PlanC argued the external shifts can bring BTC down from its current levels:

“If the Crypto market was in a bubble I would say 25k to 27.5k is the Bitcoin bottom, but there is a decent probability that macro factors drag us down to 22-24k. Significant black swan, 15-20k becomes a possibility.”

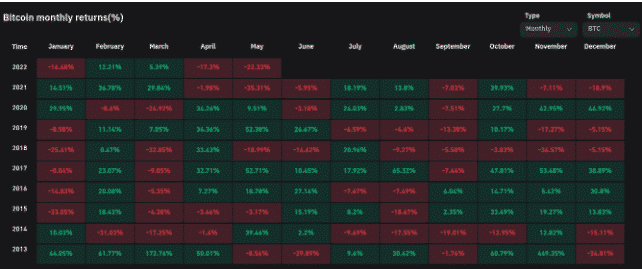

Beyond the stocks, the US dollar index consolidated after the strong retracement from the 20-year high. With the ten days left until the end of the month, BTC/USD risked May 2022 as the worst in terms of returns in history. The data from Coinglass showed its month-to-date returns totaling 22% for BTC as the largest retreat of any year except 2021. In 2022 the figures confirm was also the worst-performing five months of the year since 2018.

As recently reported, The BTC options data suggests there is a growing bearish sentiment among investors after BTC dropped to almost $24,000 in the past week and brought many systemic risks within the ecosystem like rising inflation fears. The asset slid for seven weeks as of Friday which is a new record. The asset’s price movements were highly correlated to the US markets in the past few months with some poor earnings reports and comments from the FED that showed an impact on its price.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post