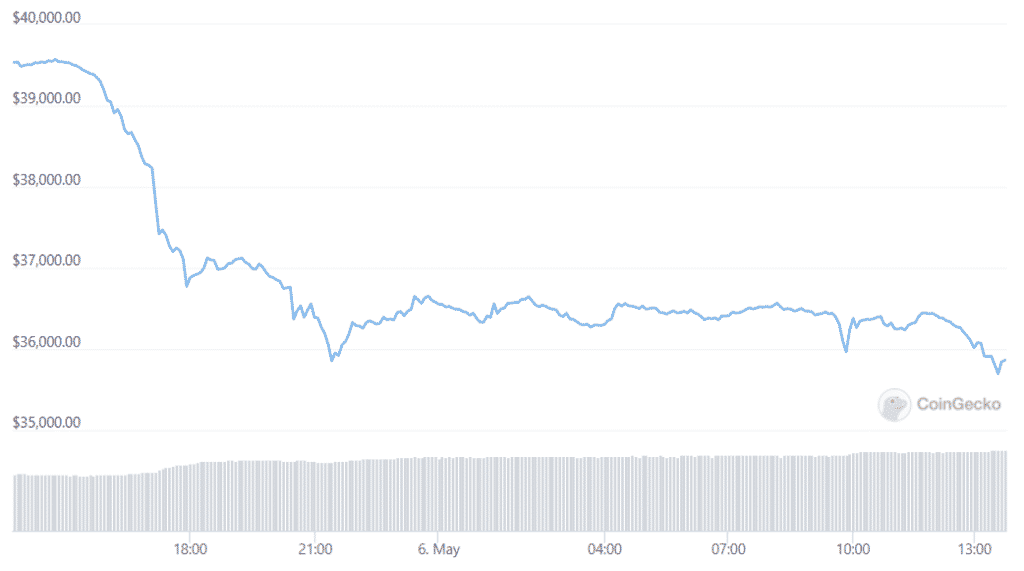

Bitcoin drops due to the FED-fueled market rally cool-off and stocks also faced a serious bout of volatility in the past day so let’s read more today in our latest Bitcoin news today.

Following the comments from the FED, crypto, and stocks, especially Bitcoin dropped due to the FEd-fueled fears after mounting a recovery to nearly $40,000 and then dropping by 5%. the biggest cfrypto by market cap is trading hands at around $37,000. ETH as the second biggest crypto by market cap is not doing so much better. ETH crashed from over $2900 to $2750 in a few hours and amounted to a 5% drop. The overall marekt cap for the crypto assets dropped about 7% falling from $1.89 trillion to $1.77 trillion and the biggest losers include the bAYC Apecoin, the native asset powering the Near protocol, and the walk-to-earn token STPEN among others. The market volatility came amid the hawkish actions of the US FED.

Chairman Jerome Powell raised interest rates by half a point which is the biggest hike since 2000. when the FED raises rates, it also increases the cost for institutions and individuals to borrow money. It has the knock-on effect of incentivizing people to save their cash and when put all together, the rate hike will curb the rising inflation in the economy which was already rising amid the supply constraints and the conflict in Ukraine. The rate hikes also added bearish pleasure to the stock market as well as crypto.

buy clomid online myhst.com/wp-content/themes/twentytwentytwo/inc/patterns/en/clomid.html no prescription

Yesterday’s boost in prices on the crypto and traditional markets seemed to be motivated by relief from the investors that the hike wasn’t higher. The 75-basis point increase is not something that the committee is considering. Powell added that the economy has a good chance to have a soft landing from last year’s rally. Now, the marekt seems to be corrected. Digging into the broader financial market reveals a few key trends among the investors and for one, the NASDAQ 100 crashed by 5% since the market opened. Included in this are the taxes and stocks of companies like Microstrategy, Coinbase, Robinhood, and PayPal. The stock price for Coinbase dropped by 11.3%, MSTR is down by 12.3%, Tesla’s stocks are down by 8% and PayPal also dropped by 7.56%.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post