Bitcoin dips below $29K with Wall Street also crashing to yearly lows, while most other altcoins follow their downfall so let’s have a closer look at today’s latest Bitcoin news.

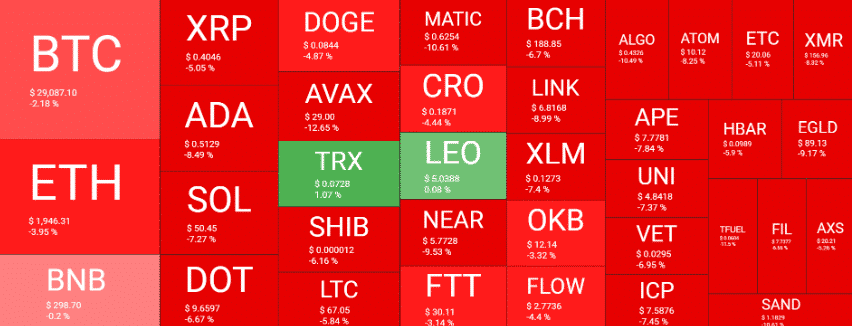

The biggest price drops came from SOL, DOT, ADA, and AVAX. The crypto market is suffering again as BTC Slipped below $29,000 while Ethereum trades below $2000. this came amid the most recent price dump on Wall Street with the biggest stock market indexes dropping to yearly lows. A day ago was quite the negative trading day on Wall Street with bigger losses coming from S&P 500, the Dow Jones Industrial Average, and NASDAQ. All of these indexes dropped by 5% in oen day with the most having lost substantially since the first months of the COVID pandemic.

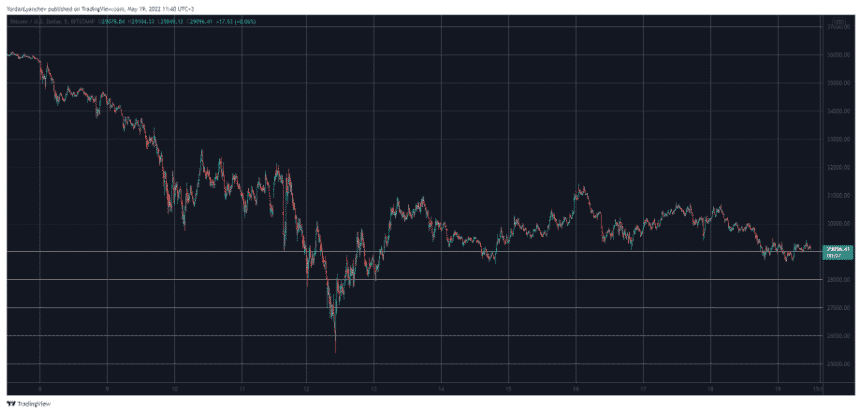

As a result, the S&P 500 dropped to over $3900 to DOW to $31,490 and the NASDAQ composite to 11,418 which was the lowest position seen in over a year. Target popped out as the biggest loser after a huge 25% drop after the company said the logistics were disrupted because of the higher freight and fuel costs. Being considered a risky asset, BTC is in the red on a daily scale. The crypto struggled at $30,000 and spiked a little above this level but then headed south again and dipped below $29,000 for the first time in four days.

BTC stands over this level but with the uncertainty spreading on most markets and the community expecting another decline. ETH was having a hard time sustaining above $2000 and the second biggest crypto lost the battle a few hours later and now trades below the coveted price tag. DOGE, SHIB, LTC, and Ripple are also down by 5% each while ADA, SOL, and DOT lost between 7%-8%. AVAX dumped the most from the bigger caps with a 13% daily drop. Bitcoin dips below $29K with the lower and mid-cap altcoins being in a similar position and the market cap is down by $70 billion in one day.

As earlier reported, Bitcoin’s seventh week of losses is unprecedented. The last time this happened was in 2014 when BTC dropped from $507 to $323 and this year, the primary cryptocurrency suffered a dramatic collapse from $46,900 to a close of about $31,300 with a 33% loss. Before the bearish turn, the top crypto by market cap surged past $45,000 for the first time in January and the market sentiment grew much bullish among traders and analysts alike as the enthusiasm over TErra’s plans to build a $10 billion BTC reserve further rallied the community.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post