Bitcoin dipped again from its weekly high with the action hovering under the short-term support targets so let’s read more today in our latest Bitcoin news.

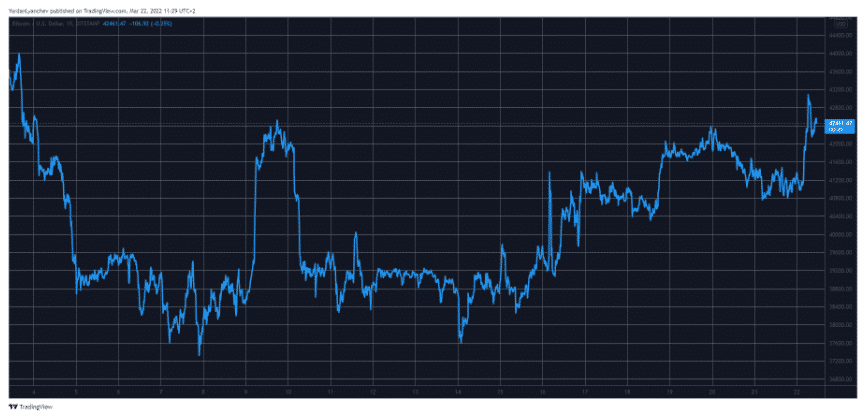

Bitcoin threatened a huge retracement overnight as the weekly highs saw their first test. BTC misses out on the bullish daily close. The data from TradingView showed BTC/USD dipping from the peak of $43,337 to lows of $41,779 on bitstamp before recovering. At the time of writing, the pair traded between $42,300 and still $1000 off the highs.

#Bitcoin closing the Daily candle above $42.6k would be very bullish

— Matthew Hyland (@MatthewHyland_) March 22, 2022

The enthusiasm was evidenced back on Tuesday thanks to the increased publicity that is focused on the Blockchain protocol Terra’s $3 billion BTC purchase. According to co-founder Do Kwon, the majority of the funds were to be used to back Terra’s new TerraUSD stablecoin whcih hasn’t been yet purchased and left the room for more potential BTC price squeezes. The mood cooled down ont the markets and BTC missed out on what was supposed to be a bullish close at $200.

Analyst Matthew Hyland was confident that the tide was turning for BTC but among other things pointing on the ongoing breakout attempt for BTC was its daily relative strength index. The downtrend had been in place since the November all-time high and the trader Credible Crypto outlined a similar level of $42,500 as an important to flip:

“42.5k has been broken, now want to see this level established as support if this is a true breakout. Meaning, the move up should hold and want to see some consolidation above this level for continuation. Let’s see what we get over the next day or two.”

Bitcoin dipped again and maybe it had something to do with Thailand deciding to ban crypto for payments which led to a sour mood from Asia while the European Central Bank balance sheet increased to record highs. At more than $9.59 trillion, the markets commentator Holger Zschaepiz started to wonder whether only the sky is the limit for the ECB asset purchases:

“Only the sky is the limit? ECB Balance Sheet has hit fresh ATH >€8.7tn. Total assets rose by another €13bn as ECB keeps buying bonds despite record-high. Eurozone inflation. Balance Sheet now equal to 82% of Eurozone GDP vs. Fed’s 37%, and BoJ’s 136%.”

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post