The Bitcoin daily mining revenue crashed in May to an 11-month low and the miners had a tough time while hash rates remain high so let’s read more today in our latest Bitcoin news.

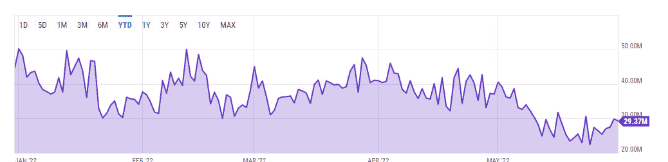

The Bitcoin daily mining revenue and profitability continued to drop alogn with the asset price this year as the crypto winter enhances. May was one of the worst months for BTC miners in the past year with the revenue and the profitability continuing to drop. The daily mining revenue dropped by 27% in May alone, as the data from Ycharts and Blockchain.com shows. The analytics provider reported a daily revenue of $40.57 million for the BTC miners and by the end of the month, it dropped to $29.37 million with the mining revenue hitting an 11-month low of $22.43 million.

May ended the streak for miners.

Every month since August 2021 saw cumulative mining revenue above $1b until now.

Last month’s mining revenue: $906m

— Zack Voell (@zackvoell) June 2, 2022

The daily mining revenue surged to a peak of $80 million but then dropped 62% to current levels. The mining profitability is a measure of the daily dollars per terahash per second and hit the lowest level since October 2020. The metrics provider now reported mining profitability of 0.112 USD per day for 1 Thash/s. The metric saw a decline of 56% since the start of the year and it is down by 75% from the 2021 highs. The BTC netowrk hash rate remained high but with the current daily average, the Exahashes per second show the figure is down by 16% from the ATH of just over 250 EH/s on May 2. The high hash rates and low profitability suggest there’s a bigger level of competition in the BTC mining sector and in the early bear markets, the miners powered down their rigs as the asset price crashed and the operations became unprofitable.

📈 #Bitcoin $BTC Miners to Exchange Flow (7d MA) just reached a 4-month high of 6.188 BTC

Previous 4-month high of 6.002 BTC was observed on 07 April 2022

View metric:https://t.co/WwBf5cbd33 pic.twitter.com/582pKlSeo5

— glassnode alerts (@glassnodealerts) June 1, 2022

The miner’s exchange flows hit a four-month high and it suggests that they might be making more preparations to sell some as cover for the falling revenue.

Last week, Cambridge Univerisity’s Centre for Alternative Finance released an update to its Bitcoin Electricity Consumption Index which in part looks to uncover and share the geographic location breakdown of BTC miners across the world. The previous update showed that the Chinese share of mining went from 34% In June 2021 to 0.0% in July 2021 after a ban on mining in the country. Last week’s update showed that china’s share of mining went from 0.0% in August 2021 to 22.3% in September 2021.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post