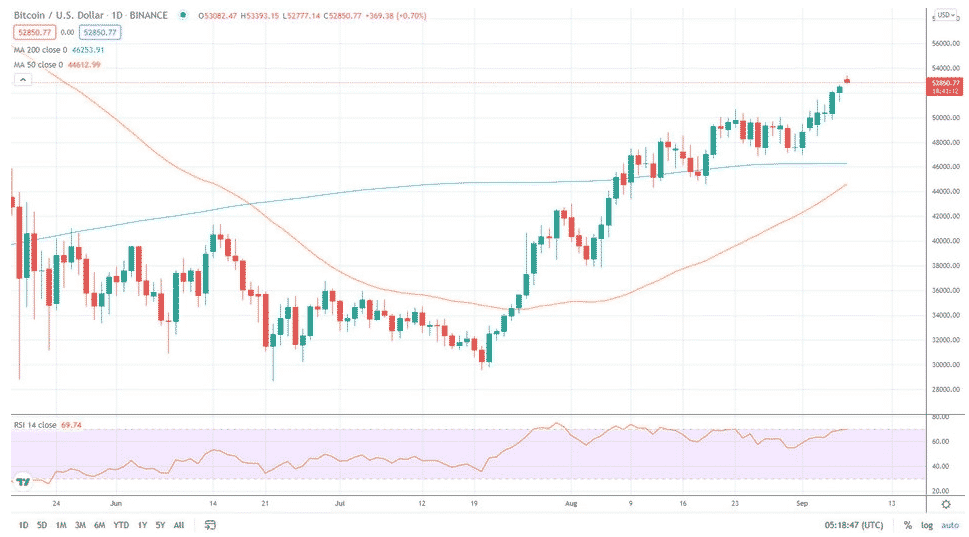

Bitcoin closes in on the $54K price range as the golden cross approaches as we can see more in our analysis in our bitcoin news today.

Building on the recent momentum, the BTC price made it to the $53K price range during the Asian trading today and the move has seen the asset at the highest price for 17 weeks which only added to the gains made on Monday. BTC trades at $52,800 according to Tradignview and what’s even more interesting is the golden cross on the daily timeframe which was imminent and likely to occur within the next day or two.

This is the longer-term bullish indicator that appears when a faster moving average crosses above the slow one. The on-chain analytics provider Glassnode commented that it seems to be the institutions that are driving the momentum again:

“As renewed optimism follows positive price action, on-chain transaction volumes are showing continued growth in dominance by large, institutional sized capital.”

In the weekly on-chain report, the company stated that BTC miners started to take profits this week amid the hash rate recovery. Over half of the hash rate recovered since the Chinese mining migration started in June:

“The increase in hash-rate is likely a combination of previously obsolete hardware finding a second lease on life, and miners in China successfully relocating, re-establishing, or re-homing their hardware and operations.”

Mining revenue returned to 2019 levels and it is now around $380,000 per Exahash. Some miners started taking profits now that BTC reclaimed the $50K level and this is still bullish but some of that revenue will be reallocated to hardware and operating expansion. The markets absorbed the selling pressure and the miners’ net position changed which returned to neutral levels. Another metric analyzed by the firm is the movement of the coins of different ages. It is observed that the majority of BTC being spent or sold at the moment is liquid as old coins remained dormant and handled.

“This indicates that conviction to HODL is extremely high and a lack of liquid supply could squeeze spot market prices higher.”

The research concluded that investors that own coins older than a year are spending much less and are holding more as the prices rally. All of the momenta lifted the altcoins too and some even outperformed BTC at the moment. As Bitcoin closes in on $54K the total market cap gained 2% to reach $2.46 trillion.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post