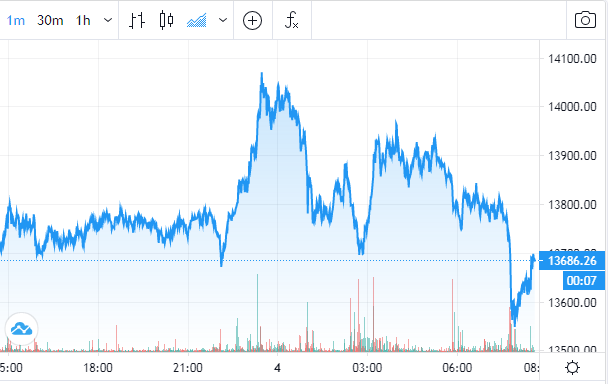

Bitcoin bulls reload their strength but the benchmark cryptocurrency still dipped towards $13,000 after failing to pass the pivotal resistance test. The price of the leading cryptocurrency crashed to $13,400 so let’s look into the price analysis in our latest bitcoin news.

The analysts think that the coin could move lower in the upcoming days. Commenting on the medium-term technicals of BTC, It shows that BTC formed a bearish divergence that fails to pass the weekly supply of the region at $14,000. This only shows that the coin could drop towards $13,000 and then potentially go lower in the days and weeks ahead:

“$BTC looks like it needs to reload. Daily SFP into weekly supply, failed break above 2019 high, bear divs flashing on the daily time frame… Bring on the election dip.”

This trader is not the only one that believes Bitcoin will reserve on the downside from here. As the reports show, analysts believe that bitcoin moving higher on the weekend could mean that it will not follow through once the weekday trading session arrives. One analyst commented on Sunday on the matter:

“I think bitcoin is putting in a temporary top. Price action to the upside when futures are closed gives me further indication that we’ll see a continued pullback into the election.”

Bitcoin pulled back as he expected and could continue to do as there remains uncertainty about the elections as they are coming to an end. Adding to the chance that bitcoin reverses to the downside, there has been a huge number of bearish events recently. Reuters reported that Hong Kong regulators will regulate all crypto trading platforms that operate in the financial hub. While this doesn’t sound so heavy-handed as China, some in this space see it as a clear attempt to clampdown on crypto activity in the region. There have also been strong regulation attempts in the US and Europe as the space continues to enter a period of strength again. These regulators could make it harder for retail investors to start getting involved in digital assets.

As reported earlier today, A Bitcoin wallet containing 69,370 or $955 million worth of Bitcoin just moved the holdings out. the wallet address of 1HQ3Go3ggs8pFnXuHVHRytPCq5fGG8Hbhx was the fourth biggest wallet in terms of crypto holdings. The coins were sitting in the wallet since 2015 when the price of the cryptocurrency was in the middle of its 0 range.

buy finasteride online herbalshifa.co.uk/wp-content/themes/twentytwentytwo/inc/patterns/en/finasteride.html no prescription

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post