Bitcoin breached the key resistance level after it rallied by 150% from the $3,700 lows as we are reading in the latest Bitcoin news.

Since the lows of $3,700, Bitcoin performed well and managed to shake off the fears of recession and depression. The benchmark cryptocurrency exploded higher from the $3,700 to $10,000 level outpacing every other asset class during the process. According to one top trader, the recent rally is much more important than the Bitcoin price rallying higher.

Another trader shared a chart where it says that despite the correction over the past few days, Bitcoin will remain above the key resistance since the downtrend was formed after Bitcoin topped the $14,000 in 2019. This time, he suggested:

“Zooming out on the three-day chart we can clearly see the downtrend from the 14k high is already broken and we are simply consolidating and retesting here.”

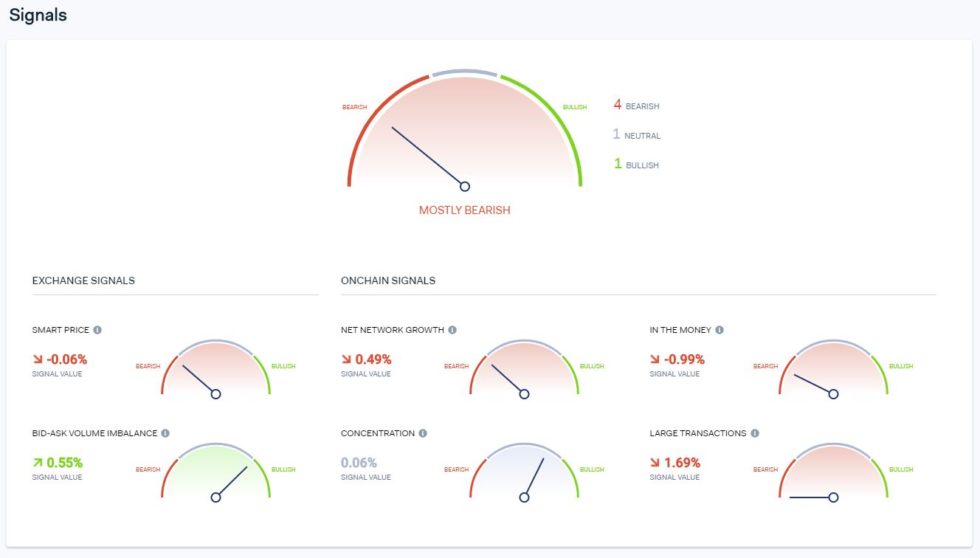

Despite the positive outlook, the trader said that Bitcoin is still fearing a downturn in the short term. Four out of six proprietary metrics of the blockchain intelligence company IntoTheBlock, show that BTC is currently mostly bearish and the number of big transactions is slowing down while the traders become unprofitable and the short-term growth of Bitcoin is slowing. The only important factors that Bitcoin has, is the slight ‘’bid-ask volume imbalance’’ to the side of bids which suggests there is a demand for the coin in spite of the price action.

Bitcoin breached the key support level but there are growing signs that the miners signed their capitulation and they are forced to turn off their machines or sell their coins. According to the data by Coin Metrics, after the block halving, the hash rate of the BTC network dropped by 30%. D’Souza said at that time that Bitcoin trades around the $8,000 and $9,000 levels which is more than 30% of miners are still unprofitable.

Preston Pysh, a crypto podcaster, believes that this trend could lead to another drop on the market in the upcoming weeks. He indicated this position in his tweet:

31 blocks behind schedule on this epoch. The rate seems to be widening as well. There might be one more bite at the apple. For all you deep hodlrs, make sure you got your buying hats ready. @mjdsouza2 @100trillionUSD @Breedlove22 https://t.co/kM5PZ8dp5V pic.twitter.com/TGNfu6Vdry

— Preston Pysh (@PrestonPysh) May 16, 2020

The data compiled by Charles Edwards suggests that after every Bitcoin miner capitulation, a stronger surge on the market happens. Edward’s predictions show that every time a capitulation was signed by the miners, the Hash Ribbons indicator predicted a macro surge.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post