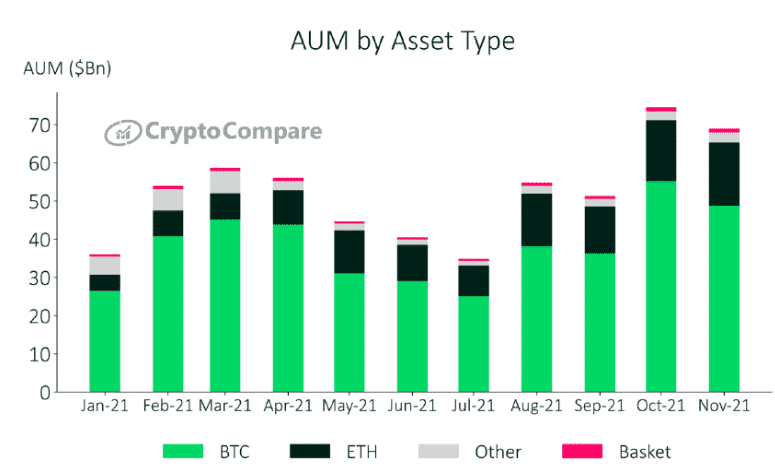

The Bitcoin AUM drops 9.5% as it saw the biggest monthly pullback since July to $48.7 billion while other altcoin-based funds such as ETH saw their AUM rise 5.4% to $16.6 billion so let’s read more in our latest Bitcoin news today.

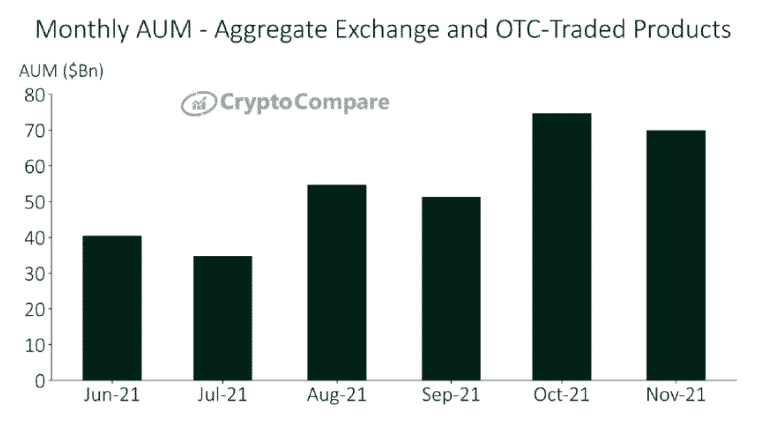

While Bitcoin’s position as a viable hedge against fiat inflation is attracting investors heavily, new data reflects a change in sentiment as ETH and other crypto products pick up the steam against the dropping Bitcoin assets under management. The Bitcoin AUM drops 9.5% to $48.7 billion which marked the year’s biggest month-on-month pullback according to CryptoCompare reports. On the other hand, altcoin-based funds such as ETH Saw their AUM rise to $16.6 billion. As shown in the graphs, the total AUM across all digital asset investment products dropped 5.5% to $70 billion that coincides with the ongoing bear market since BTC achieved an all-time high of $65000.

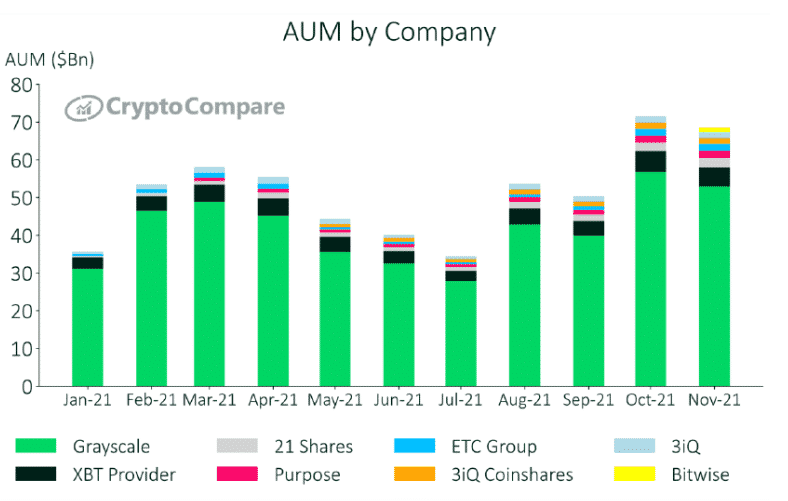

As a result of the 9.5% fall, the Bitcoin aUM market is about 70% of the total AUM share. Ethereum’s AUM increased by 5.4% while AUMs representing other crypto assets increased by $2.6 billion. Out of the total AUM offerings, Grayscale products amounted to 76.8% of the AUM market with the Grayscale dominated trust products dropping to $54,5 billion. Other players include XBT Provider and 21Shares by 7.2% and 3.6% respectively. According to the report, weekly flows into BTC-based products averaged $94.4 million and out of the other $67.8 million, ETH-based products contributed to about $24.4 million while Tron-based and Cardan-based products amounted to about $10.7 million.

American giant Morgan Stanley reported an increase in exposure to Bitcoin via the purchase of shares of Grayscale Bitcoin Trust. Their recent filing with the US SEC outlined a 63% increase in Grayscale Bitcoin Trust holding. Sporting a market price of $45, Morgan Stanley’s BTC-centric portfolio surpassed $300 million aimed at a BTC exposure without direct investments in crypto.

As recently reported, Bitcoin was 12.4% down from a week ago with the concerns over the US’s $1.2 trillion infrastructure bill mounted. The bill introduced tax reporting requirements for a variety of different crypto services such as exchanges like Binance, Coinbase, and more that are considered brokers. They will now have to provide the government with 1099 forms disclosing the names and addresses of their users making transactions. The non-custodial wallets could be considered brokers under the new regulation which posed some hard questions about the type of data they collect from their customers.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post