Barrons reported that “Big Money” is behind the latest Bitcoin rally, as the price of the number one cryptocurrency was hovering above $18,000 after the short-term correction from $16,200 so let’s read more in our Bitcoin news today.

Barrons reported that BTC could potentially move higher as, over the past few months, the market saw an influx of institutional capital. There were different on-chain metrics, corporate figures, and exchange volume trends like Grayscale’s assets under management which show continuous growth in the institutional demand. The mainstream media and prominent analysts expect the institution-led rally to get a stronger momentum in future rallies.

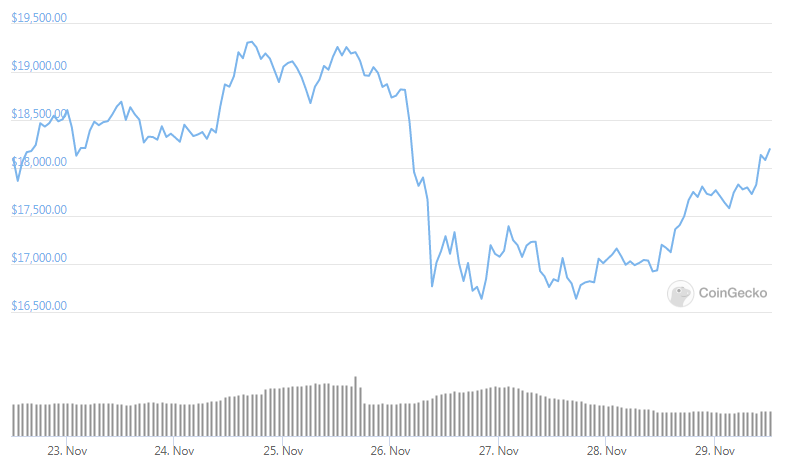

Over the past three months, BTC rallied strongly and portrayed a staircase-like rally. BTC rallied, consolidated, and then rallied again, showing resilience and strong momentum. During the previous bull cycles, BTC saw strong corrections and price swings. There were a few liquidations as well which caused mayhem on the market. BTC saw a huge pullback over the weekend but the rally was stable since September. The strong uptrend of BTC could be due to the growing buyer demand from the institutions and the high net-worth investors that poured money into BTC.

The reports also show that Guggenheim’s fund filed with the US Securities and Exchange Commission in order to reserve the right to invest more than $500 million into the Greyscale BTC Trust. A tech researcher Kevin Rooke said:

“Guggenheim’s $5 billion Macro Opportunities Fund wants Bitcoin exposure. On Friday they filed an SEC amendment allowing them to invest up to 10% of their fund in $GBTC. A 10% investment would be worth $487M, and would be $200M+ larger than their next largest position.”

After the news came out, Deribit found that the options market is increasing in buyer activity and the institutions that invest in BTC will fuel the market in two ways. Also, when institutions start buying BTC, they will create a strong buyer demand because they invest tends to hundreds of millions of dollars at a time. in the near-term, some analysts are becoming cautious towards BTC. For example, Ki-Young Ju, the CEO of CryptoQuant said:

“When retail investors depositing under $25k stablecoins are active on exchanges, the market is likely to be a bearish or a fake bull.”

Despite the interest in BTC stemming from the growing institutional adoption, the analysts predict a near-term trajectory that will be quite hard for BTC. If the benchmark crypto sees dwindling momentum, it could consolidate or pullback before the next uptrend.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post