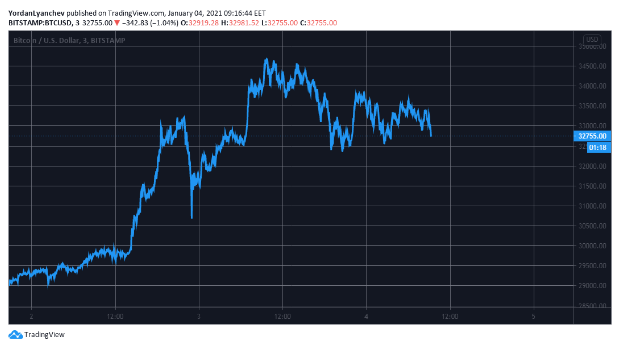

As BTC’s price slumps below $32,000, about $1.17 billion of the Bitcoin longs got liquidated and now the derivatives traders that opened these bullish positions are starting at massive losses as we can see in our latest Bitcoin news.

The data provided by ByBt.com shows that the BTC/USD pair liquidated the Bitcoin longs contracts which were worth $1.17 billion so the stop-losses triggered as the BTC price dropped back below $30,000 in the middle of the corrective spot market move. This way, the traders were left with open short positions in the profitable state. The figures indicate that the long position holders on Binance lost about $339 million followed by Huobi whose traders suffered $258 million of losses. This marked the Bitcoin market’s worst one-day liquidation after November 25 in 2020 which ended up in traders losing about $999 million. however, none of the recent major long liquidations materialized into the broader bearish trend.

Spot traders remained long-term bullish on BTC owing to the increasing prominence as a hedging asset among mainstream financial institutions and other corporations with one after November for example, seeing the BTC/USD exchange rate climbing by about 114% to settle a record high of $34,810. Many analysts admitted that the institutional investors utilized the retail-led price drops to purchase BTC en masse so as a result, the flagship crypto-asset rallied higher and developed more support zones near $16,200, $17,650, and $22,000. For example, one analyst said that Bitcoin’s ongoing dip will wash out what he thinks are “retail degens” so the cryptocurrency will move from weak to strong hands.

buy flagyl online http://expertcomptablenantes.com/wp-content/themes/twentytwentyone/classes/new/flagyl.html no prescription

People treat BTC as a safe haven asset against falling bond yields and the US dollar which serves as the reason why billionaire investors like Paul Tudor Jones integrated the crypto in their portfolios. This explains why MicroStrategy and MassMutual as well as a few others, opted to invest in BTC. BTC investors treated the 20-day exponential moving average wave as the medium-term support and each downside price correction stops at or ahead of the floor before resuming the move upwards.

LIQUIDATION CASCADE

— Byzantine General (@ByzGeneral) January 4, 2021

Right now, as BTC’s price slumps, we could expect downside correction to this level at $26,500 but in the meantime, a slip below the 20-EMA exposes a further bearish move at the 50-day simple moving average near $21,500.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post