ARK invest claims both BTC and ETH market caps will reach $20 trillion by 2030 because the decentralized finance applications built on Ethereum are flipping the traditional financial service providers as we can see further in today’s latest altcoin news.

A new report by Ark Invest claims that Ethereum’s market cap in the next few years could rise to over $20 trillion while that of the crypto market cap will be worth as much as $50 trillion, judging by the current growth of utility and efficiency. According to the report, Ethereum’s growth in the past two years can be tied to the developments and the adoption of decentralized finance in the public.

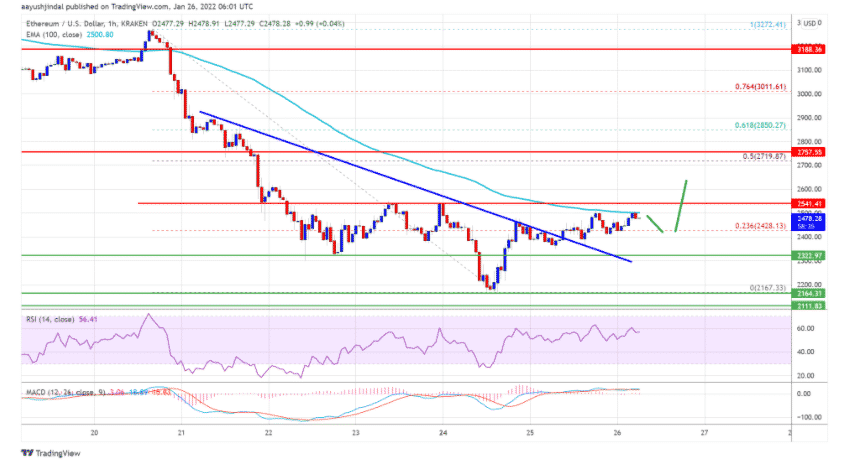

DEFI promises more transparency, more interoperability, and financial services while minimizing the fees and the counterparty risk. After a turbulent 2018 and 2019, ETH emerged in 2021 as the predominant smart contract platform for DEFI and NFTs. ARK noted that Ethereum and its applications will be able to flip the services being provided by the traditional financial institutions and that the token of the blockchain can compete as a glboal currency. The reports outlined the fact that ETH dapps are usurping the traditional financial functions as the margin. If ETH’s market cap were to increase to $20 trillion by 2030 it means that the value of the asset will increase to over $170,000 per unit.

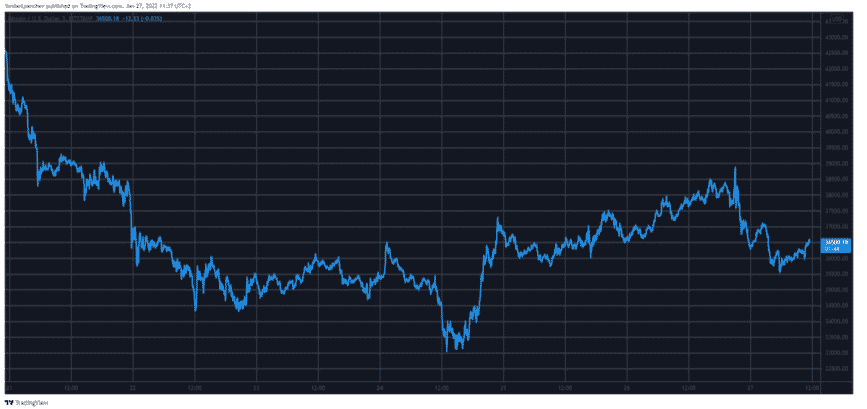

The second biggest crypto asset by market cap is trading for less than $2500 after the market alongside the broader market crashed at the start of the year. On Bitcoin, ARk Investment predicted that the value of the currency will rise along with the increase in adoption of the coin that will see in a lot of countries in the world.

buy valtrex generic buy valtrex online no prescription

This will lead to the value of BTC rising to over $1 million while the market cap will be inches away from $30 trillion. In addition to the statement, Ark expects BTC to account for about half of the global remittances made in 2030 and it also predicts the assets to play a bigger role in the emerging markets and transaction settlements in the US.

Another of the predictions was that the institutional investors will embrace BTC investments and that it will eat a chunk of the gold total market cap. While BTC mining is generally a contentious problem due to the energy consumed by the space, Ark Says BTC mining was going to incentivize other ways and forms of energy generation.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post