ARK Invest bought additional $10.8 million in Grayscale’s BTC trust as Cathie Wood doubles down on its BTC-focused stocks as we are reading more in today’s Bitcoin news.

Amid the rough 48 hours for the crypto markets, Ark Invest bought additional $10.8 million in Grayscale BTC trust, led by Cathie Wood. Over the past two days, the New York-based company bought 210,681 shares of Coinbase worth as much as $47.39 million as well as 450,224 shares of GBTC worth over $10.8 million. Right now, one Coinbase share trades at $224 while GBTC closed the trade on Tuesday at $24.02.

According to the data by Ark Invest, the company bought 48,977 shares of Coinbase for its Generation Internet ETF and 22,900 for the ARK Innovation ETF. More purchases followed as 120,069 Coinbase shares were added to the company and an additional 18,735 to the ARK Fintech Innovation ETF. The company then increased its stake in GBTC adding 310,067 shares on Monday with the addition of 140,157 shares on Tuesday and both purchases were made via ARKW.

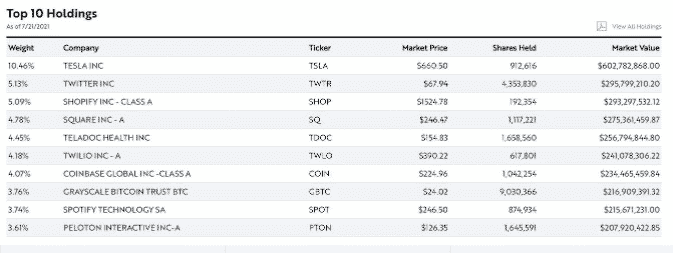

ARK Invest wanted to become the first to buy Coinbase stock after the exchange debuted on the NASDAQ earlier this year. The firm has since started growing its stake in the San Francisco-based company and increased its combined stake to $1.3 billion. It is a different story with GBTC as the last time Wood’s company purchased Grayscale’s Bitcoin stock which was a month ago when the price of BTC dipped below $30,000 for the first time this summer. At press time, BTC is trading hands at $30,932 which got up by 4.3% over the past day. The two last purchases brought ARKW’s total holdings of GBTC to over 9 million shares that were worth $216.9 million but despite the increased amount of shares, GBTC’s weight in ARKW dropped from 3.99% to 3.76% while Coinbase made it to the top ten with a new weighting of 4.07%.

ARKW is one of the company’s ETFs, is topped by Tesla, Shopify, and Twitter. After the Friday $54 million purchase of the Square stock, the payment company has bolstered its presence, moving to the fourth position. Cathie Wood’s company holds a stake in Square via both ARKK and ARKF with a combined value of $1.8 billion.

When ARK invest as the New York-based investment management firm by Cathie wood, filed for a bitcoin ETF, it joined the ranks of a few other US firms that hope to convince the Securities and Exchange Commission to allow the launch of the ETF tracking the price of Bitcoin.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post