One analyst gives $100K BTC price prediction amidst the current bubble rumors with the price correcting lower after it rallied to a record high of $32,000. In our latest bitcoin news, we are taking a closer look at his prediction.

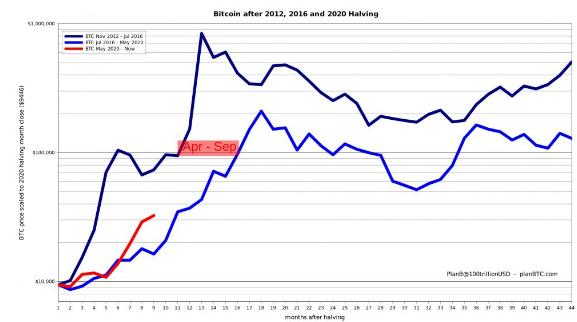

PlanB, the analyst who created the Stock-to-Flow prediction model, said that he sees the benchmark cryptocurrency hitting $100K anytime between the second and third fiscal quarters of 2021. He based his bullish analogy on the BTC market performances after the halving event which cut the active supply by half. PlanB noted:

“If history is any guidance and bitcoin continues its current trajectory, BTC could be $100K somewhere between April and September.”

The analyst gives $100K prediction for BTC taking cues from the limited supply cap of 21 million and as the production rates slow down, the demand will increase as well with the probability of rallying higher getting stronger. This serves as the base for the stock-to-flow model which sees both BTC/USD at 8 by the end of the year.

buy benicar generic https://blobuyinfo.com/benicar.html over the counter

So far, the model prove to be accurate and followed the projection curve that can be seen in PlanB’s data. Its verifiable correctness promoted many traders and analysts to cite a bullish backdrop for BTC.

The macro investors and veteran managers had plenty of concerns that the BTC price rally could turn out to be a bubble. After the rebound from the COVID-19 crash last March, the cryptocurrency made multiple highs in Q4 of 2020 as well as in the first quarter of this year as it surged by more than 1000 at one time in January. This opened BTC/USD to bearish scrutiny with strategists thinking that the price moved beyond its actual worth. In the statements to the Financial Times, founder of Baupost Group Seth Klarman said that investors “misplaced impression” about BTC and also the BTC and stock market’s long-term bullishness. GMO co-founder Jeremy Grantham warned of overvaluations and of an upcoming “epic bubble.”

Analysts in the BTC space are betting on sustainable growth for BTC even if it meets a strong bearish correction on the way. William Nemirovsky who is an analyst at River Financial said:

“The United States is positioned for a period of huge spending and budget deficits, with high levels of inflation all but guaranteed. Currently, all parts of the United States government are supporting the price of Bitcoin, and have given no indication that their positions will be changing in the near future.”

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post