About 1% of bitcoin’s supply is now wrapped in Ethereum, approaching 189,000 BTC as we can see in our Bitcoin news today.

The total supply of WBTC was only around 4000 coins last June and now it is 47 times higher than that. The gigantic growth made the token the most popular form of BTC on the Ethereum blockchain. Overall, more than 240,000 BTC was tokenized into ETH protocols out of which 80% of the supply comprised of WBTC. Tokenized BTC is becoming popular because the Bitcoin blockchain lacks a little functionality that ETH does not.

buy cialis pack online https://idhfa.org/pdfs/new/cialis-pack.html no prescription

As the DeFi system is getting more lucrative, it is not surprising that investors are looking to get their hands on these yields.

WBTC is not the only BTC token on Ethereum as RENBTC and HBTC are some of the other examples. However, only WBTC is noticing these massive growths, and below there is a chart that visualizes the difference between WBTC and other tokens. It is clear from all the charts there a competition of the token that is stagnant and lesser in circulation that makes up about 20% of the total BTC supply on Ethereum and now about 1% of Bitcoin’s supply is wrapped on Ethereum.

BadgerDAO for example is a decentralized autonomous organization that aims to build the products and infrastructure that is necessary to bring BTC as collateral to other blockchains. BadgerDAO played a huge role in Wrapped Bitcoin rise above its competition and now the platform has $632 million in tokens locked in. There are 13 vaults on the website where you can deposit your tokens and a lot of these sets are pairs of liquidity of WBTC so as a natural consequence, not all of the value is locked under the wrapped token.

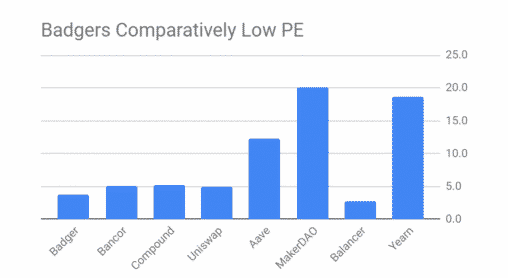

There is a WBTC only set which is powered by Yearn Finance and the vault is now the biggest one on the platform with $200 million tokens deposited. The charts from BadgerDao’s reports show that there has one of the lowest price-to-earnings ratios when compared to other businesses. In the past 30 days, the value of crypto dropped by 14% and the general trend seems to have changed in the past week. 87% of the respondents in the Voyager Digital survey plan to buy more crypto and 7 out of 10 respondents believe that the market sentiment is bullish in the next three months.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post