The latest Bitcoin news show that the most dominant coin has been climbing up lately and going above almost all resistance levels. The situation over the past month has made many people bullish, and a new BTC price prediction shows a major potential for the largest coin by market cap to breach the $50,000 mark.

After spending many weeks in the green, the general sentiment shows that the cryptocurrency market flipped bullish as many sellers are exhausted and unable to continue the attack. According to Jurrier Timmer, who is the head at Global Macronomics within the firm Fidelity, the cryptonews show a new BTC price prediction where Bitcoin could go over a hurdle as it did many times throughout history.

Meanwhile, the HODLers continue to accumulate, and now make up 12% of the market. /END pic.twitter.com/0IloagcZox

— Jurrien Timmer (@TimmerFidelity) August 20, 2021

As Timmer sums up, Bitcoin’s current price action is very similar to the distribution phase we saw during February and April, when the price seemed stuck but afterwards moved to the upside:

“With the latest rally, bitcoin’s market cap is closing in on the old highs. If we add in the rest of the crypto space, we have reclaimed a market cap of $2 trillion. This is no longer a sideshow, folks.”

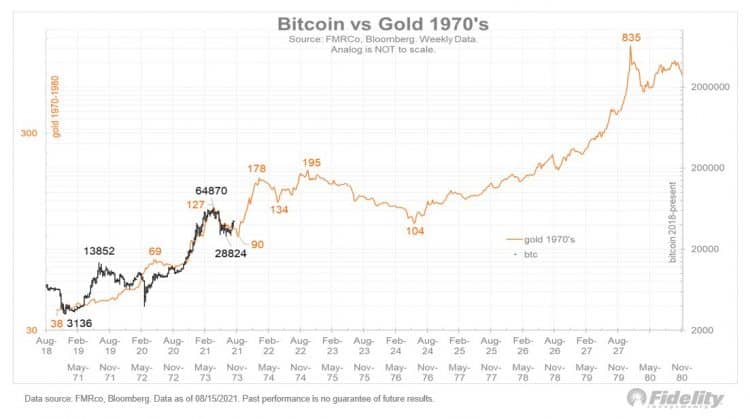

In addition, many cryptocurrency experts believe that a new BTC price prediction would push the coin above its potential, and Timmer is the same. He even went to compare BTC’s performance with gold in 1970, and a chart below shows that the dominant coin and the precious metal behaved similarly. However, Timmer reassured the public that this prediction is still “highly subjective” and could be a sign of future appreciation as Bitcoin takes over the market share that gold has.

“In fact, bitcoin’s fundamentals (its network) are steadily improving. At the peak, there were 34.3 million addresses (with at least $1). That number fell to 31.8 million at the low and has now climbed back up to 33.5 million,” he added.

The expert also introduced a potential demand model that is based on an S-curve pattern which is typically used to determine the tech’s adoption level. This model intersected in July, creating a “good base from which the Bitcoin price can consolidate.” According to Timmer:

“Bitcoin’s hash rate is climbing back from the abyss (following the mining ban in China), although it remains well below the peak. Higher prices will likely fix that as mining follows demand.”

In the long term, the expert added that the miner’s migration from China along with other factors may push the coin and we might see a new BTC price prediction that matches the coin’s all-time high at $64,000.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post