A bear trap could bring bitcoin lower as the cryptocurrency switched its short-term market bias from bullish to bearish in 14 days alone. The benchmark cryptocurrency attracted the sellers right when it established a fresh record high at $42,000 so let’s have a closer look at price analysis in our Bitcoin latest news.

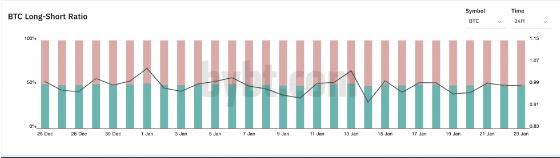

The flagship cryptocurrency attracted sellers right when it established a fresh record higher than $42,000. The price then dropped by 31.57% and recovered due to the strong buying sentiment at key psychological levels around $30K. The latest weekend session was supposed to protect the long-term bullish bias so the traders started buying bitcoin immediately which led the coin to a new drop of around $30,931. The price retraced back above $33K in the early Monday session making the ninth downside rejection since the beginning of January.

Josh Rager who is the co-founder of BlockRoots.com was quite optimistic about the BTC rebound saying that the cryptocurrency is close above $34K this week according to a 21-day exponential moving average with a history of predicting bullish and bearish trends. He explained:

“Price is currently retesting the 21 EMA, and a break and close above $34k on higher time frames would be a great start. And would showcase this as a bear-trap before more upside.”

During the first week of January, the calendar had a flurry of events that provide more insights into the US Economy status and so far, the deceleration pushed investors into safe-haven assets like BTC, gold, and stocks. The US Conference Board will release the consumer confidence readings and also expects to see a rebound in the US Economy that the traders will pass on as “soft data.” Another report by the University of Michigan gave some more insight on the deceleration that was seen in the fourth quarter of 2020.

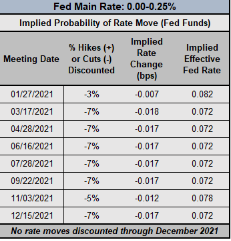

The weak readings will likely drive the US government into launching harsher protective measures starting with an expansive stimulus package to aid people and businesses in the COVID pandemic. This however could weaken the US dollar and limit growth in the US Treasury yields but the fundamentals look bullish for Bitcoin. in the meantime, the Federal Reserve’s first policy meeting is about to happen which could pose as a bear trap for BTC that could crash it even lower. Analysts believe that chairman Jerome Powell will keep the benchmark rates at zero until 2023 which is expected to keep the US dollar less volatile.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post