90% of BTC has been mined so far as it has been one of the greatly debated issues in the blockchain space as miners make a good amount of blocks mined given the price of BTC as of now. However, the mining difficulty has also gone up as more BTC are mined so how long it remains until all of the coins are mined? Let’s find out in our latest Bitcoin news today.

In its history, over 18.6 million of BTC’s 21 million total supply has been mined and this constitutes about 90% of the Bitcoins supply which leaves 10% of BTC left to be mined and there are about 2250 million coins to be left to be mined. At this rate, it is estimated that the last BTC will be mined about 120 years from now and this is due to the halving events that will happen every four years reducing the supply of BTC going into the circulation every four years.

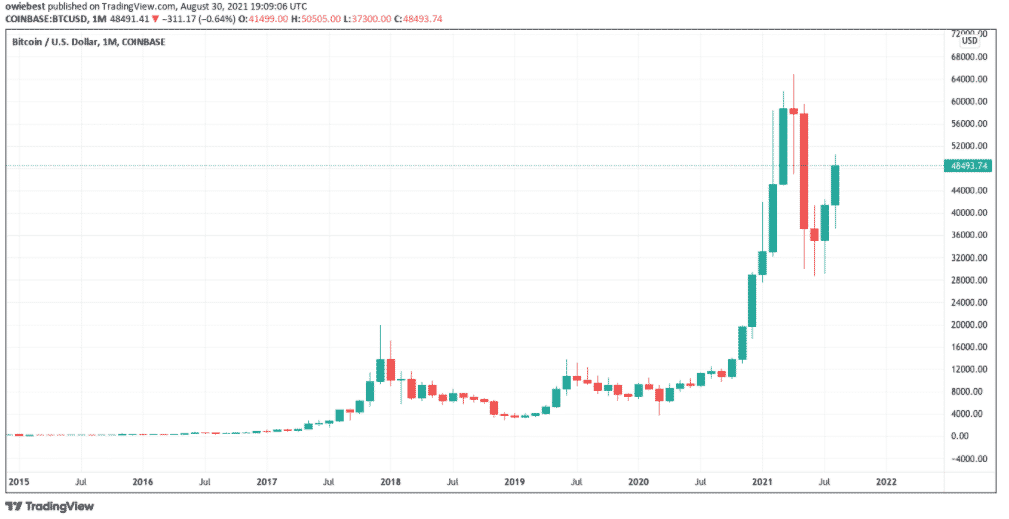

The crypto which first came out in 2009, rewarded miners 50 BTC for each block which they mined. This was back when the user could mine BTC using old laptops with a crappy graphics card but at this point, Bitcoin was worth almost nothing so a lot of miners forgot their coins or even sold them for very cheap. BTC’s price evolution until now is at an interesting point. In 2021, three halving events since the launch of crypto have been a reward for block mined reduced dramatically. The first halving happened in 2012 and at that point, the reward for a block was 25 and reduced by half. The next halving occurred in 2016 which reduced the reward to 12.5 and the most recent halving happened in 2020 which eventually reduced the number of BTC recieved per mined block to 6.25.

The reward will continue to halve every four years until all 21 million BTC are mined and each halving will reduce teh rewards for mined blocks by half each time. It will make the rewards for mining blocks smaller while increasing the mining difficulty as miners clamor to get rewards for the mined blocks. The number one cryptocurrency didn’t draw too much attention until the Silk Road issue happen so before this was launched, BTC was only used by people who were in it for the technology. The returns were not important at that point as the BTC on Silk Road as a way to purchase anything from drugs to weapons is what made law enforcement turn the focus on the coin.

BTC’s price remained flat around this time despite its popularity and all of that because of the Silk Road bust. The notable bull run happened in 2017 and 2018 which was when investors had heard about BTC while the bull market brought BTC to the forefront as the strogn asset to contend with.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post