In our latest cryptocurrency expert analysis, we are pointing out to the recent bearish trend – and talking about Bitcoin, Ethereum as well as many altcoins which all contributed to the new billion dollar loss for the market this year alone.

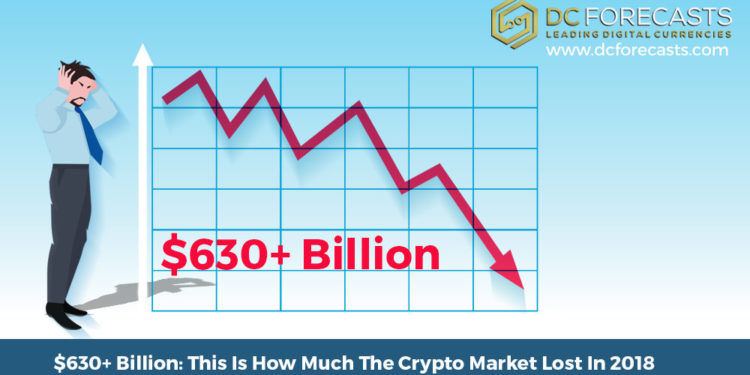

From the all-time high of $829.96 billion, the total cryptocurrency market cap is now around $196.9 billion, which marks a decrease of more than $633 billion – all of which money that has been dumped across the cryptocurrency exchanges in 2018.

In percents, this means that the market lost close to 76% of its all-time high capital – and depreciated even lower than its mid-2017 bottom.

buy amitriptyline online https://viagra4pleasurerx.com/dir/amitriptyline.html no prescription

The market right now consists of both performing and non-performing cryptocurrencies. Most of these performing assets experienced sell-offs at peak, even with the corrections afterwards.

buy wellbutrin online https://viagra4pleasurerx.com/dir/wellbutrin.html no prescription

The problem is that new money are constantly entering the cryptocurrency sphere, especially from retail investors that contributed to the growing demand of crypto in 2017. However, everyone can agree that Bitcoin may have grown due to speculations – which is the reason why most of the altcoins are recording huge losses.

The only chance of bringing retail investors on board and stabilizing the crypto market right now is clear regulation – possibly with the exchange-traded funds (ETFs) or options getting a legal status.

However, traders are confident that new highs may be on the horizon – and that their crypto holdings “are not a loss until they are sold.”

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post