$4 billion of BTC and other crypto coins were liquidated one day after Tesla made its announcement that it halted BTC payments due to environmental concerns as we reported in our Bitcoin news.

Over the past 24 hours, we saw $4 billion of BTC and other coins got liquidated after Tesla’s decision to stop BTC payments. Today is a bloody day in the crypto market with the current downturn being propelled by Tesla’s recent announcement which shows that the company won’t accept BTC as payment for its electric vehicles. The car manufacturer announced that it will no longer accept BTC for its products.

Elon Musk retweeted the decision which quoted environmental issues related to the energy-intensive BTC mining process. This had plenty in the community banging their heads on the wall as to why Musk changed his mind after he agreed with Jack Dorsey that BTC incentivizes renewable energy. The damage is done now and the crypto market is bleeding in response. The total capitalization lost about $400 billion in the past 24 hours.

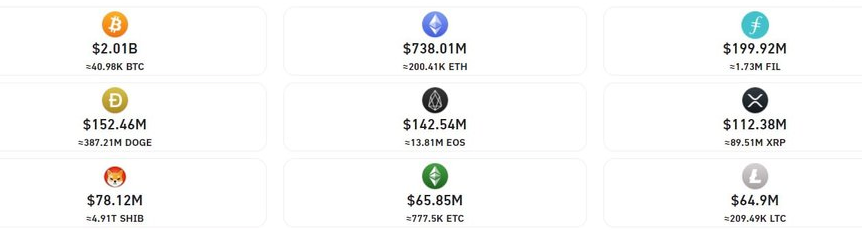

Moreover, around $4 billion worth of long and short positions were liquidated at the same time as per the data by ByBt. BTC markets account for the majority of the liquidations and stand at over $2 billion at press time after ETH and Filecoin. Almost 90% of the liquidations were long positions where ByBt and Huobi occupied the first two spots in terms of volume after Okex and Binance.

As recently reported, Earlier this year in what seemed to be a huge win for the crypto space, Tesla started accepting payments in bitcoin and this move was widely supported and celebrated for legitimizing Bitcoin’s transactional utility beyond a speculative asset class. Tesla’s CEO Elon Musk posted on Twitter to announce that Tesla stops BTC payments because of concerns over the rapidly increasing use of fossil fuels for BTC mining. The concerns are nothing new as many already criticized the digital asset and its proof of work system for the hefty electrical consumption.

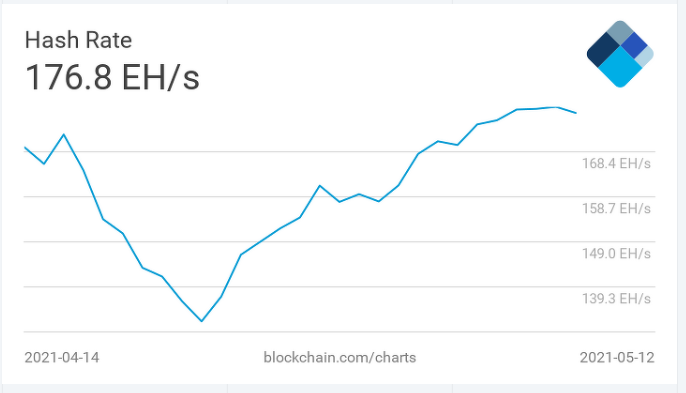

Bitcoin’s surge in price has incentivized miners to expand their operations which led to an annualized consumption levels that surpassed that of smaller nations. According to the University of Cambridge’s Bitcoin Electricity Consumption Index, the miners around the world account for 147 terawatts in electrical consumption which is about 0.5% of global power usage.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post