As $4 billion in options expire, Bitcoin and Ethereum started crashing and struggling as we can see more in our latest cryptocurrency news today.

$4 billion in options expire today which can oftentimes move prices as both cryptos started dropping already. Bitcoin, Ethereum, and the rest of the market took a hit over the past 24 hours. BTC and ETH are down by 7.6% and 8% respectively in the past day. Bitcoin and Ethereum options are derivatives contracts that provide the buyers with a right to buy the assets at a certain price in the future so when the options expire, the market can become volatile because there will be traders that will continue to hold or dump their crypto buys. This happened and already and the market crashed.

Bitcoin options represented 83,700 BTC and 685,000 in ETH that expired which is a record amount of options contracts expiring in one day for ETH and both assets started struggling which suggests that traders choose to sell. Ki-Young Ju who is the CEO of CryptoQuant added that he believed this was evidence of a bear market especially as ETH supply across all exchanges which were increasing and meaning that the investors are perhaps for a sell-off:

“I think it’s plausible [it is causing volatility] since it’s the largest ever options expiry [for Ethereum].”

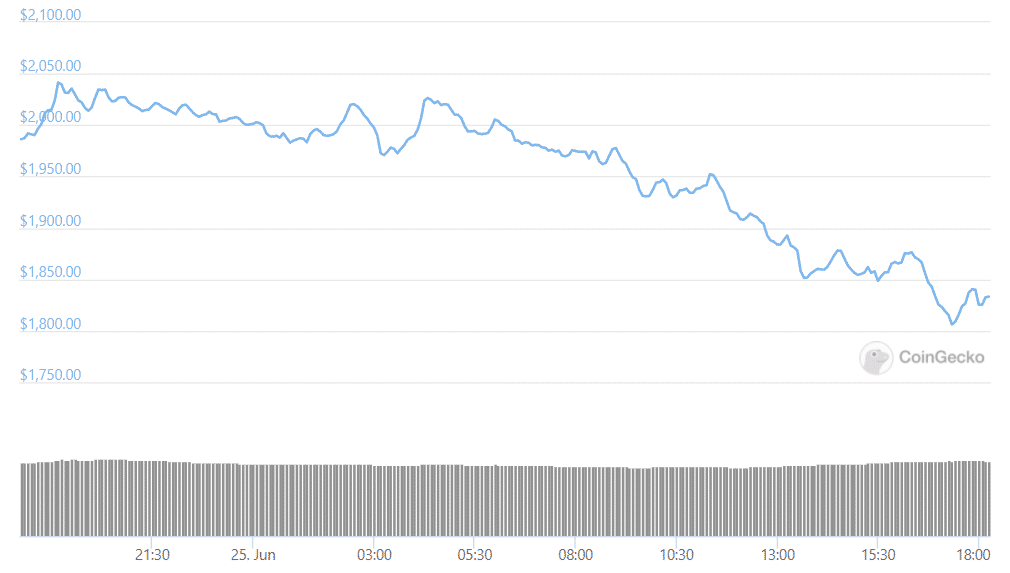

Bitcoin fell below the $30,000 price point for the first time since January and ETH dipped below the $2000 price range which represented a number of reasons for the crash but China is still to blame with the country’s central bank this week told five of the country’s biggest banks as well as payments platform Alipay to stop doing all crypto businesses. This is only the latest in a string of moves from the country targeting the industry. Before this, the country moved to enforce the BTC mining ban and sent the price of the currency down to the pan, and doubled down on the ban from 2017 on financial institutions and payment companies engaged in crypto transactions.

The Chinese miners are looking outside of the country’s borders to continue their operations which is also compounding the price drop of today as other experts believe. Alexandre Lores who is an NFT Analyst for Quantum Economics said that it was “more likely a matter of technical selling pressure” with the market struggling:

“Bitcoin faced a strong rejection around $35,000, and when it failed to break through resistance at that level, it headed toward support around $31,500. If this support holds, bitcoin may head back to $35,000. Most coins in the market, such as ether, are heavily correlated to BTC/USD at the moment.”

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post