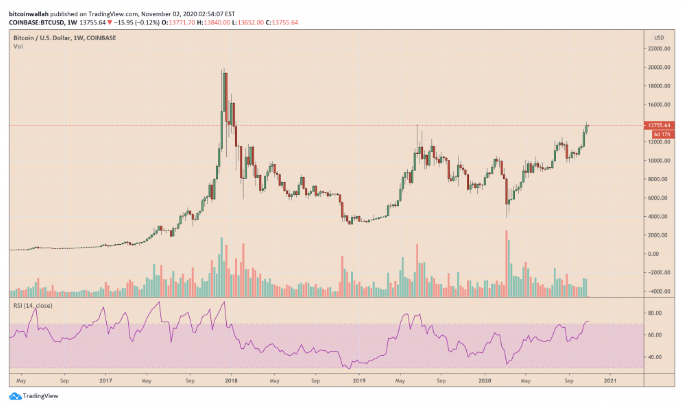

A 30% pullback should be expected for Bitcoin as its bull run is about to hit hard the strong resistance according to an independent analyst Josh Rager so let’s read more in today’s Bitcoin news.

The number one cryptocurrency could fall as low as 30 percent according to Blockroots co-founder while speaking of the earlier pullbacks. He noted that BTC/USD has a thing for logging extreme retracement after the relentless rally which mentions nine of these cases in the recent history where the bull markets resulted in the corrections of about 30 percent. The bearish analogy appeared despite the good outlook for the BTC market in the long-term. the cryptocurrency surged about 90% in 2020 and traded as high as $14,098 back on Friday. That was its highest level since 2018 when it was correcting lower after gaining $20,000. Most traders including Mr.Rager agreed that Bitcoin reclaimed the $14,000 level on a general agreement that the cryptocurrency is hedging against the inflation with a limited supply of 21 million tokens that usually outweigh the potential benefits of holding fiat currencies with infinite supply.

Another strong weekly close on high time frame

With that said, let the "dips" come

It shouldn't surprise anyone who's been in this market when it happens

Bitcoin had 9+ pullbacks of at least 30% last bull market

But in the long run, we know where this is going (up)

— Josh Rager 📈 (@Josh_Rager) November 2, 2020

The increase in the number of coronavirus cases and the strong blow to the global economy, made some central banks to unleash quantitative easing policies so more money enters the market and is boosting the purchasing power. As a result, investors are migrating their cash reserves to riskier assets which include stocks, gold, and Bitcoin. This explains that the cryptocurrency’s price rally is up by 265 percent as of Friday. Rager saw this as an upcoming bearish correction answer from the bulls. The analyst admitted that the drop will prove instrumental in attracting more investors to the market. to them, it would be an opportunity to secure a scarce asset for a discount:

“In the long run, we know where this is going (up).”

Most of these investments expect to come from traditional companies as Bakkt President Adam White said that hedge funds, brokerage houses, and other companies are “taking a hard look at crypto and Bitcoin.” He reported that daily trades on their futures platforms surged from 1,300 in 2019 to 8,700 in 2020. The 30% pullback in Bitcoin only shows that the adoption is increasing as well especially now after PayPal decided to add cryptocurrencies to its existing list of offerings. This decision combined with hundreds of millions of dollars worth of investment from software companies MicroStrategy and PayPal helped the asset rise from $130 billion to $255 billion in October.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post