27% of Bitcoin’s supply is held in 10,000 whale wallets despite the growing adoption over the past few years so let’s take a closer look at today’s Bitcoin news today.

This hasn’t deterred investors as some $30 billion were poured into the space in 2021 and this is actually more than the previous years combined. A lot of politicians and celebrities took a portion of their salaries in BTC. El Salvador made it a legal tender and there are three BTC futures ETFs that are currently trading on the Chicago Board Options Exchange. The vast majority of the volume, about 75% of it, moved from one exchange to another and there’s a small number of “rich” whale wallets that control 27% of Bitcoin’s supply according to the latest reports from the National Bureau of Economic Research.

The report is not new as it is a working paper that was published on the NBER website in October thanks to the data collected through the end of June. The findings got a bump this morning when the Wall Street Journal reported that 0.01% of BTC holders control 27% of the currency in circulation. The top 1000 investors control about 3 million or about 16% of the circulating BTC and the top 10,000 investors own about 5 million or 27% of BTC according to Igor Makarov from the London School of Economics and Antoinette Shcoar from MIT’s Sloan School of Management.

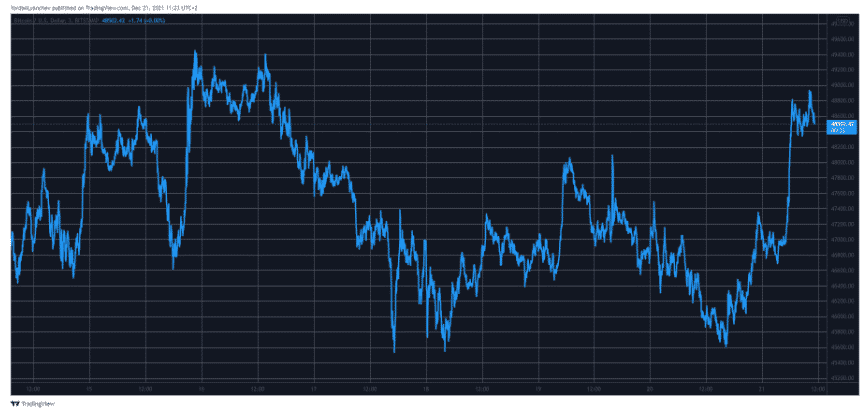

At the time the researchers complied the data, there were about 18.7 million BTC in circulation and 787,000 active wallet addresses but for perspective, there’s now 18.9 million BTC in circulation with 733,000 active addresses. The BTC price was sitting near $34,493 in June and increased about $13,000 to $47,222 as of the time of writing. It is important to point out that the researchers used clustering algorithms to separate the addresses controlled by the same entity such as hedge funds or addresses controlled by individual investors. If the data included wallets controlled by big companies that 0.01% stat will be much higher. The authors write:

“Our data cover 1,043 different entities. These include 393 exchanges, 86 gambling sites, 39 online wallets, 33 payment processors, 63 mining pools, 35 scammers, 227 ransomware attackers, 151 dark net marketplaces, and illegal services.”

The apparent concentration of wealth hasn’t dulled the interest of other investors that are looking for the next best thing in Blockchain. This year, about $30 billion of venture capital was poured into blockcahin, web3, and digital assets as well as metaverse startups according to the Pitchbook data. Spencer Bogart who is a general partner at Blockchain Capital said:

“We’ve got financial services, art, gaming as a subcategory of NFTs, Web 3.0, decentralized social media, play-to-earn—all of that made investors think, ‘We don’t have enough exposure.'”

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post