Binance.US accused in a class-action lawsuit that was filed on behalf of investors in connection to the crash of the Terra USD stablecoin, who claim they were misled so let’s read more today in our latest Binance news.

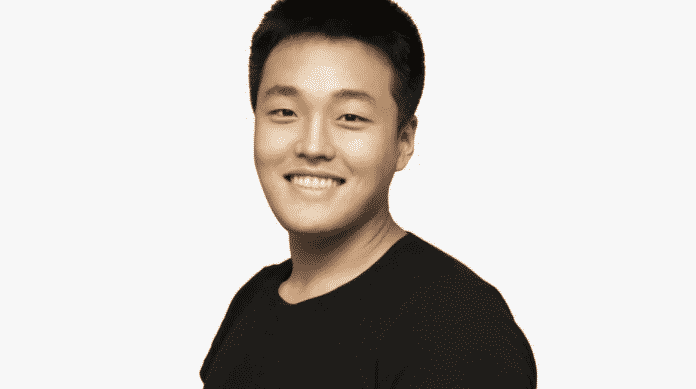

The Terra blockchain founder Do Kwon wanted to convince crypto investors to put their money into TerraUSD which promised will stay priced at $1 but unfortunately, his confidence was not enough to save UST and the rest of the Terra project which crashed to zero:

“Those of you waiting for the earth to become unstable- I’m afraid you will be waiting until the age of men expires.”

I’m up – amusing morning

Anon, you could listen to CT influensooors about UST depegging for the 69th time

Or you could remember they’re all now poor, and go for a run instead

Wyd

— Do Kwon 🌕 (@stablekwon) May 7, 2022

Over 2000 Terra investors say the false marketing is what cause them to lose their money and in the class-action lawsuit filed on Monday, Binance.US accused of misleading investors around the Terra blockchain ecosystem. The suit marked the first US-based court filing relating to TErra whose LUNCand UST tokens wiped out $40 billion in investor funds when they crashed to almost zero last month. Along with the seasoned big-money backers such as Hashed and PAradigm, the Terra collapse drained the wallets of thousands of retail investors and in the days after Terra’s drop, the biggest Reddit forum was filled with accounts of suicides and people who struggled and couldn’t find help.

The suit that was filed by the US company Roche Freedman LLP, alleged that Binance.US marketed Terra’s dollar-based UST as being more stable than it actually was. As per the suit, when UST and LUNC crashed to zero, thousands of unsuspecting retail investors were caught off guard and the misleading advertising is what the suit said it so blame for the losses. The lawsuit alleges that Binance.US is not registered as a broker or dealer which could be in the valuation of securities laws after it listed what it might be unregistered security in UST.

While a successful suit sends chills down the spines of some DEFI founders and CEOS, it will embolden DEFI advocates who think that decentralized tools for participating in the crypto finance are needed to avoid governemnt censorship and the regulations moving forward. Alogn with seasoned backers like Hashed and Paradigm, the Terra collapse drained the wallets of thousands of retail investors and in the days after Terra’s decline, the biggest Reddit forum was filled with accounts of suicides with the forum featuring criticism of Terra’s founder Do Kwon.

Kown is mainly to blame for hyping the promise that UST will be safe at $1 and he said he built a system that onlookers like Kevin Zhou say was sure to fail according to a recent interview. Upon these foundations, Kwon promoted the safety of UST on social media and dismissed critics like Zhou.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post