Binance suspended all deposits in Nigeria as the central bank of the country told all financial institutions they couldn’t provide crypto companies with banking services. The country temporarily suspended all deposits in the local fiat currency of the country in the response to the letter from the Nigerian Central Bank as we can read more in today’s Binance news.

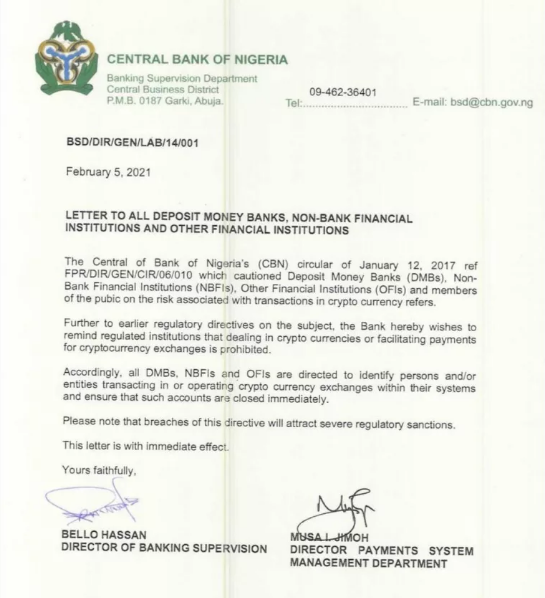

The central bank of Nigeria instructed local banks to close all accounts that are related to crypto platforms or crypto operations. The CBN letter urged that banks that deal with crypto or facilitate payments for crypto exchanges are banned under a 2017 circular stating that BTC and other crypto assets are not legal tenders in the country. While the move could impact fiat on-and off-ramps most of the trading in the country occurs on peer-to-peer platforms and remains unaffected.

In a statement, Binance announced that its Nigerian naira payment partners suspended the deposits services until further notice saying that it will monitor the situation closely:

“Withdrawal services remain normal and will continue to be processed but might take slightly longer time than usual.”

The CBN directive came a few months after protestors in the country used BTC to raise funds after the authorities shuttered bank accounts that were associated with the movement. Since the letter started making rounds on the internet, the Nigerian crypto users tweeted the hashtag #WeWantOutCryptoBack more than 26,000 times according to the data. However, professionals in the crypto space don’t believe that this panic will last or will have any impact on crypto adoption. The Nigeria-based software and blockchain engineer Tosin Olugbenga explained that the CBN could have issued the directive because of the price run of BTC in 2020 and the increasing interest across the world that causes Nigerians to convert their earnings to crypto:

“They’re moving money from naira to crypto. That is what the CBN sees and has taken issue with. It is not banning crypto trading. It’s just telling financial institutions not to allow their platforms to be used to buy or sell crypto on exchanges like binance.”

Olugbenga added that most of the crypto transactions happen on peer to peer exchanges either way so once the panic dampens, crypto trading will continue as usual. Aronu Ugochukwu who is the executive officer of the Xend Finance platform said:

“The news has caused a panic in the crypto space, especially for new crypto investors, but the true essence of crypto is decentralization. [The] majority of crypto trades that occur in Nigeria are peer-to-peer.”

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post