Binance halted trading for Terra and decided to delist LUNA and UST as well after they crashed in price so let’s have a closer look at today’s latest Binance news.

After a warning of delisting, the crypto industry’s biggest exchange Binance halted trading for Terra and removed all of the trading pairs for LUNA and UST. The world’s biggest exchange announced that it delisted both UST and LUNA so the tokens were removed from both margin and sports markets as of today. The exchange also warned users about delisiting the LUNA and Tether trading pairs if the price of the coin dropped below $0.005.

Updates:

🔸Notice of removal of some margin and spot trading pairs at 12:40am UTC, May 13, 2022.

🔸Adjusting of tick size for spot trading pair at 12:40am UTC, May 13, 2022. https://t.co/jijqNqaTdJ— Binance (@binance) May 13, 2022

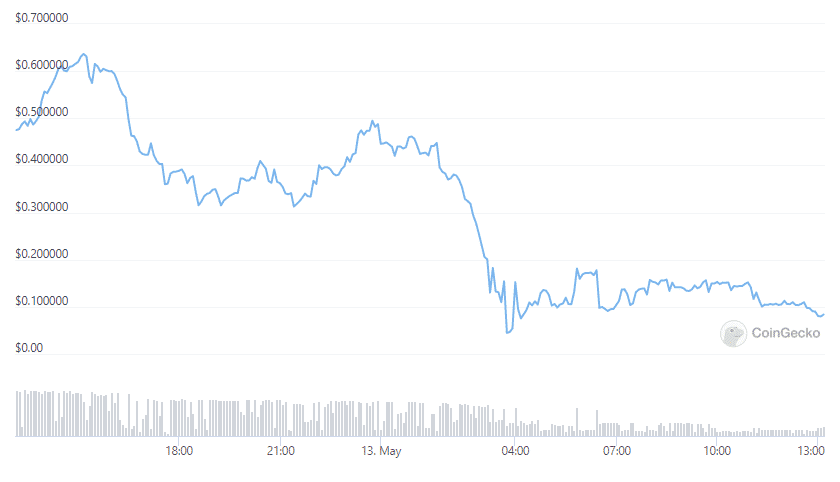

Earlier this week, Binance halted the withdrawals temporarily of UST and LUNA owing to network congestion that was caused by the high volume of pending withdrawals. Terra’s native governance and staking token crashes by almost 100% a day ago and now trades at $0.00005395 as per the data from coinmarketcap. LUNA’s crash was attributed to the pairing with UST. USt is an algorithmic stablecoin and unlike the collateralized ones like USDT and USDC, the stablecoins are not backed by real-world assets but the variety of the stablecoin is governed by the self-executing smart contracts.

LUNA is designed to help stabilize UST at the dollar peg with a mint and burn mechanism so the users could swap $1 worth of LUNA for UST and vice versa. Each time that LUNA gets swapped for UST, the coin is also burned. This week, however, the mechansim came under immense pressure until UST started losing its dollar peg. The investors tried to shift UST into LUNA and the latter token got minted en masse. The arbitrage between UST and LUNA resulted in a high selling pressure on LUNA which accelerated the token’s crash.

The UST dollar-pegged stablecoin is now trading at $0.17 as per the data from CoinGEcko. The Terra Builder Alliance as well tried to save the ecosystem amid its collapse and created a proposal to stop the operations of UST as an algorithmic stablecoin. Once all of the UST has been swapped to LUNA, the stablecoin will cease to exist in its current form. The proposal also aims to create the collateralized stablecoin but it is unclear what it will look like.

“It doesn’t look like the peg stability mechanism is going to restore peg in the short period of time. Once the UST has been swapped with Luna at the new network launch, it will cease to exist in its current form and will be relaunched after genesis in collateralized form.”

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post