Binance gets under investigation by the IRS and the Department of Justice for money laundering and tax evasion as we can see more in our latest cryptocurrency news today.

According to Bloomberg, the federal probe is still confidential with both agencies looking for information from individuals that have insight into Binance’s business. The report accuses Binance of succeeding without strong government oversight with a lack of corporate headquarters and incorporation in the Cayman Islands that levies no taxes and offers looser business practices. A Binance spokesperson said:

“We take our legal obligations very seriously and engage with regulators and law enforcement in a collaborative fashion. We have worked hard to build a robust compliance program that incorporates anti-money laundering principles and tools used by financial institutions to detect and address suspicious activity.”

BREAKING: Binance, the world's biggest crypto exchange, is under investigation by the Justice Department and IRS https://t.co/mk0Njo7tUE

— Bloomberg Crypto (@crypto) May 13, 2021

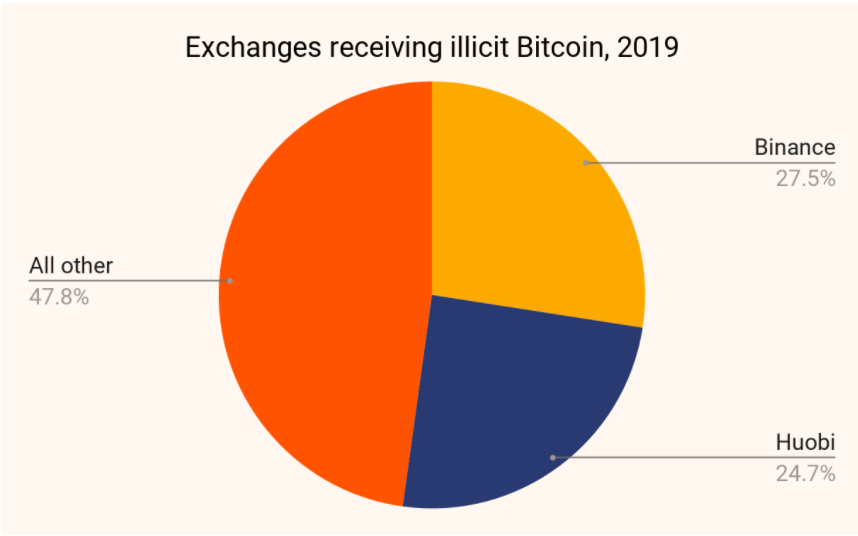

One of the biggest criticism of BTC and the entire crypto space has been the use for conducting crimes. Back in January, we saw Treasury Secretary Janet Yellen raising concerns over crypto being used in illegal terrorist financing, but also we saw figures like Charlie Munger who associated the crypto space with kidnappers and extortionists. Chainalysis which is a blockchain data analytics company used by US Federal agencies, reported that binance was tied with criminals that perform criminal activity based on the transaction analyzed.

“Binance and Huobi lead all exchanges in illicit Bitcoin received by a significant margin. That may come as a surprise given that Binance and Huobi are two of the largest exchanges operating, and are subject to KYC regulations. How can they be receiving so much Bitcoin from criminal sources? Let’s start by looking at the specific accounts receiving illicit funds at both exchanges.”

This is not the first time that Binance got embroiled in some legal troubles as the exchange’s venture into stock tokens landed the company under the radar of the European regulators including the UK Financial Conduct and Germany’s BaFin. Binance hired former US Senator Max Baucus as its regulatory advisor.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post