The analysts turn bullish as the finding rate for Bitcoin on Binance turned negative since the cryptocurrency underwent a strong drop since the highs seen yesterday. The price of the leading cryptocurrency dropped from its highs of $13,850 to lows of $12,900 so let’s read more in today’s Bitcoin news.

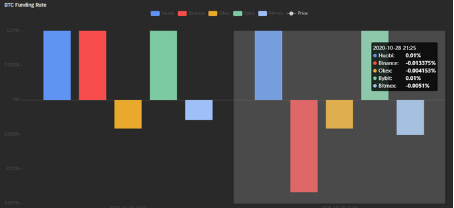

The drop resulted after a drop in the US stock market. The Dow Jones and the S&P 500 have dropped the hardest in the past few months as they dropped by 3% lower during some uncertainty about fiscal stimulus before the US election. Bitcoin’s price action scared some of the investors therefore the futures markets started to show short positioning. This could be more bullish than bearish despite how contrary this could seem. The strong drop lower scared a lot of the investors that were once exuberant and according to the data from ByBit, the BTC funding rate on Binance breached negative territory by printing -0.013%/ eight hours which is why analysts turn bullish. One of them even said that this negative print is a huge deal and said:

“Binance funding being negative is a pretty big deal. Just saying. A bunch of plebs is gonna get their lunch money taken away soon.”

The funding rate is the recurring fee that the long positions per day short positions regularly to normalize the price of the future to the price of the spot market. The funding rate shows which side of the market is more aggressive or if the funding rate is positive. It also suggests that there are more aggressive longs than shorts and also the other way around. Binance’s funding rate turned negative which is notable as the rate on exchanges is often neutral or at a positive level. Analysts still remain bullish thanks to the number of technical analysis trends.

Analyst Tony Spilotro shared a chart where it shows that Bitcoin is in the middle of the macro RSI breakout. As the charts show, each time an RSI looked like this, the crypto surged dramatically higher. The cryptocurrency was rejected at $13,800 as mentioned before but the RSI analysis suggested that bitcoin has still room to rally in the upcoming days and weeks once the bulls regain force.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post