1inch DEX aggregator has successfully raised $2.8 million in a financing round by Binance Labs as a venture arm of the leading crypto exchange as we are reading further in the upcoming Binance news.

The 1inch DEX aggregator that sources liquidity from multiple platforms raised about $3 million in a funding round led by Binance Labs. There were other prominent participants such as Libertus Capital, Galaxy Digital, Greenfield One, FTX, Divergence Ventures, and more. The decentralized exchange aggregator had successful completion of the funding round that came shortly after the DEX aggregator reached a huge milestone of more than $1 billion in overall volume.

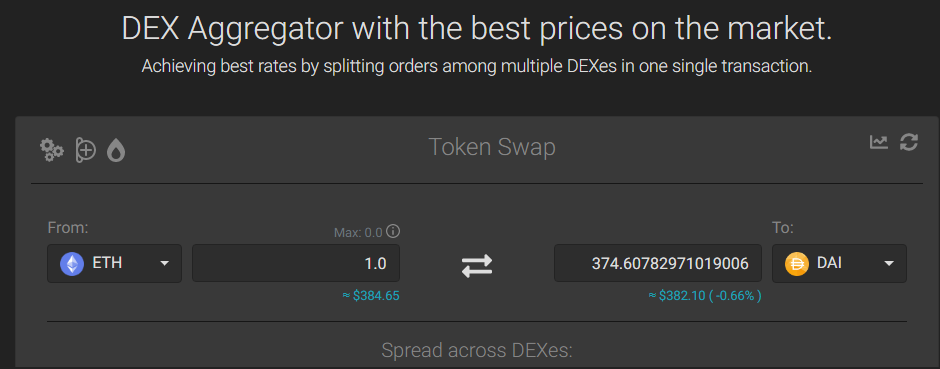

Launched in 2019, the platform uses smart contract technology to split the single trade transaction across other decentralized exchanges. It enables users to optimize and to optimize each trade. Some of the most popular platforms that use 1inch, include Airswap, Uniswap, Kyber Network, Balancer, Curve, Bancor, and more. After this financing round, the company aims to double down on product expansion and team growth:

“The funds raised in the first investment round will be used to grow the team further, to develop our algorithm together with new innovative products, and to run marketing activities. We believe that the gold rush in DeFi is in full swing and 1inch has full potential to become the first DeFi unicorn company.”

The company released a new search algorithm for swapping the routes named Pathfinder. After implementing it, the aggregator experienced improved speed and efficiency to its aggregator. The company’s automated market maker resolved a lot of issues of impairment loss by simply reducing the arbitrageurs’ earnings will still increasing the liquidity provider earnings. One of the upcoming products scheduled for the launch in August is the algorithm that utilizes 1inch API to respond in “less than a second to find the best trading paths and is completely free for B2B integrations.”

Changpeng Zhao, the CEO of Binance, spoke on the funding round and their involvement with 1inch. According to him, both companies started working together right after the platform was launched last year. CZ noted that his company was excited to support 1inch:

“DEX aggregation is a critical building block that co-enabled the most recent DeFi boom. It allows executing large order sizes at low slippage rates. 1inch has become the de facto interface for trade execution in DeFi, with aggregate volumes surpassing $1 billion.”

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post