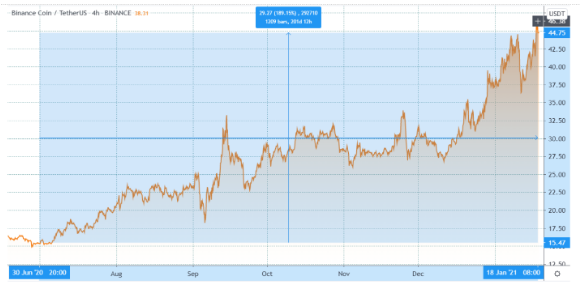

Binance’s Coin reaches a new all-time high one day before its scheduled token burn as we can see more in today’s Binance coin news.

The growing DEX ecosystem and the low fee incentives are what’s pushing Binance’s coin to a new all-time high a day ahead of its scheduled token burn. Over the past six months, BNB was rallying higher and gained about 189% the period, hitting a price of $46.90 with the price happening one day before its quarterly token burn which led the investors to question whether or not the price will move higher soon.

A token burn is a permanent removal of the coins from circulation and this technique is a common practice that is used by many projects in the space. The process doesn’t destroy the coins but makes them unusable. Aside from the supply change, the binance Chain launched a smart contract capability which allows the Decentralised Finance applications and cross-chain assets swaps to come aboard as well. The exchange was wildly profitable since the launch so all of these factors are giving us a good reason for the price rise and Binance’s Coin reaches an ATH doesn’t look like too far from here.

When binance Futures rolled out, the exchange announced that the futures platform revenue will be included in the BNB quarterly burn and the coins that were taken out of circulation will show a percentage of the earnings for the latest quarter of 2020. Despite becoming the market leader on futures contracts, the growing exchange launched the service quite recently. Over the past 16 months, since it was launched, the platform grew by about $4 billion open interest and the number surpassed more established derivatives exchanges such as BitMEX, OKEx, and Huobi.

Binance stated that it will repurchase the coins slated for destruction but these policies changed back in 2019. The actual token burn process involves reducing the potential supply until it reaches the 100 billion goal. The latest BNB burning round happened on October 16, 2020, involving a total of 2.25 million coins. The supply stands at 142.41 million but Messari calculates about 108.35 million liquid supply. The difference came from coins that are restricted or vested which means that they are not actually being traded.

The data from The Tie, the recent price spike was accompanied by a sharp increase in Twitter user activity but this is not a fundamental factor that shows that the more attention the token gets on social media, it will become easier to gather the buying pressure.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post