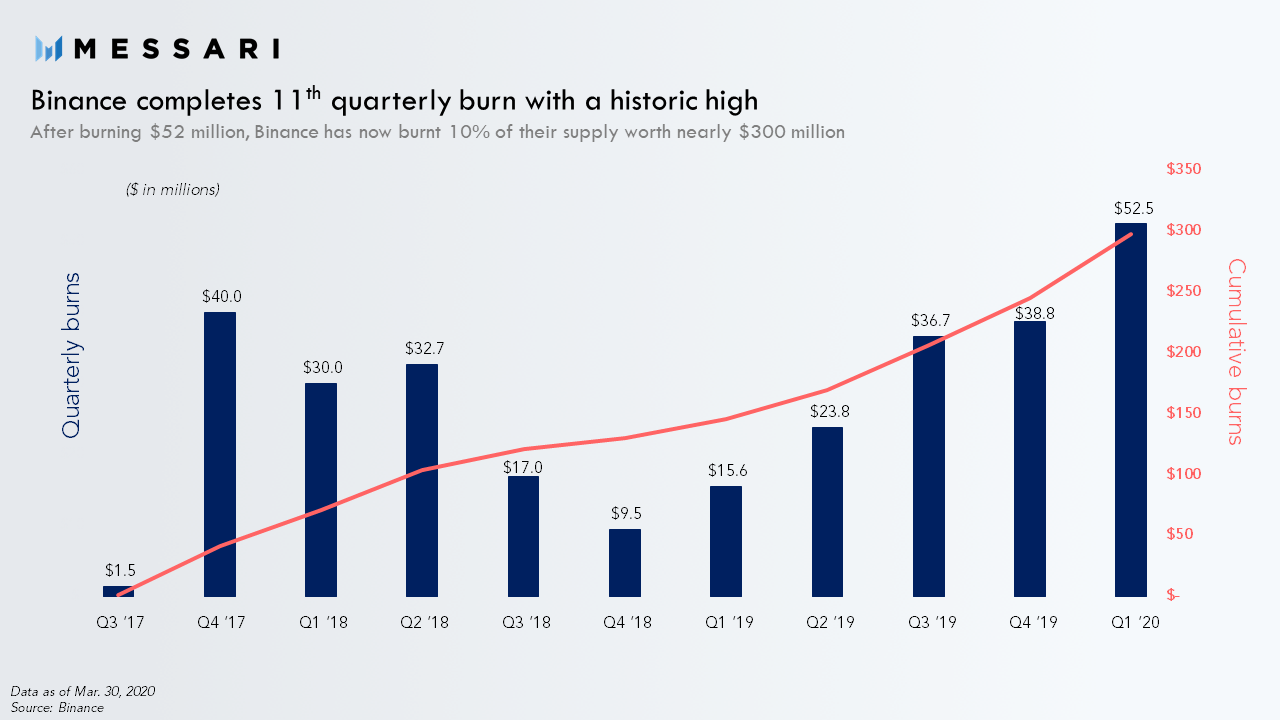

The major cryptocurrency exchange Binance recently revealed that it finished its 11th quarterly token burn which totaled $52.5 million worth of its native cryptocurrency, BNB. The latest Binance Coin update in the cryptonews shows that nearly 3.4 million tokens were taken out of circulation. This amount represents the biggest BNB burn ever recorded.

According to the CEO of the exchange, Changpeng Zhao, thanks to the success of multiple achievements, product rollouts and initiatives throughout the first quarter of this year (Q1 2020), his company was able to burn a vast number of tokens.

“Binance Futures grew to be the No. 1 crypto futures exchange in the world by volume, with 24 perpetual contracts. We maintained our leading position in spot trading with 600+ trading pairs. We also continued expanding our fiat-to-crypto channels, supporting 42 major fiat currencies with a combination of peer-to-peer trading, credit card purchases, and direct bank deposits… All of the above contributed to the high burn number for Q1,” Zhao noted.

To date, we can see that Binance has burnt around 10% of the total BNB supply worth nearly $300 million, as data from Messari shows (pictured below).

According to the crypto insights and market intelligence provider, the token burn strategy which Binance implemented creates “constant buying demand” for BNB. This means that as traders rush to buy the token to pay for trading activity fees in the exchange, there is a massive demand for BNB.

Our latest Binance Coin update also shows that a constant increase in demand with a significant reduction of supply could sooner or later have serious implications on the price of Binance Coin. This is what Jack Purdy (who is a research analyst at Messari) recently noted.

Binance’s $50 million burn is still a big deal

And it doesn’t matter that they burn from their treasury

Why you ask? pic.twitter.com/S4TvyGsGzj

— Jack Purdy (@jpurd17) April 18, 2020

Purdy said that BNB “requires traders to continually repurchase tokens to get the discount” and that the “buy-back from the company subsequently burns them.” He also said that if Binance continues to burn $50 million or more every quarter, “the value of BNB should still, in theory, rise, if there is a demand for the token.”

Different on-chain metrics in the Binance Coin news also reveal that there is more room for BNB to go up. At its current pace, Binance Coin (BNB) is surging and may reach a monthly high soon.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post