The Celsius legal team says customers signed over their crypto and up to 80% of the funds were at its disposal and not the users’ so let’s have a closer look at today’s latest cryptocurrency news.

After a month of issues, Celsius Network filed for Chapter 11 bankruptcy protection and before the pretense dropped, customers’ access to the funds was cut off while the lender looked for solutions to stay afloat. Now, after the first bankruptcy hearing, the Celsius legal team allegedly floated a new idea aimed at preventing a collapse and claimed ownership over the users’ funds. The line was repeated all over since the MtGox happening but the warning seems to have been well placed once again so a few days ago, the economists predicted that the investors might essentially be left with no money after the court proceedings are over:

“Celsius is not an asset manager, it’s a shadow bank. And deposits in banks aren’t even “customer assets,” let alone “assets under management. Celsius’s terms of use make it completely clear that customers who deposit funds in Celsius’ interest-bearing accounts are lending their funds to Celsius to do with as it pleases. And it specifically says that in the event of bankruptcy, customers might not get all – or indeed any – of their money back.

buy female viagra online blackmenheal.org/wp-content/themes/twentytwentytwo/inc/patterns/en/female-viagra.html no prescription

”

Today was the First Day hearing for the @CelsiusNetwork bankruptcy. I want to take a shower after having listened. Celsius blamed everyone except itself. Celsius has pivoted in how it describes itself, from banking the unbanked to basically being a bitcoin mining company. #ComeOn pic.twitter.com/cWpHzppvll

— David Silver (SILVER MILLER) (@dcsilver) July 18, 2022

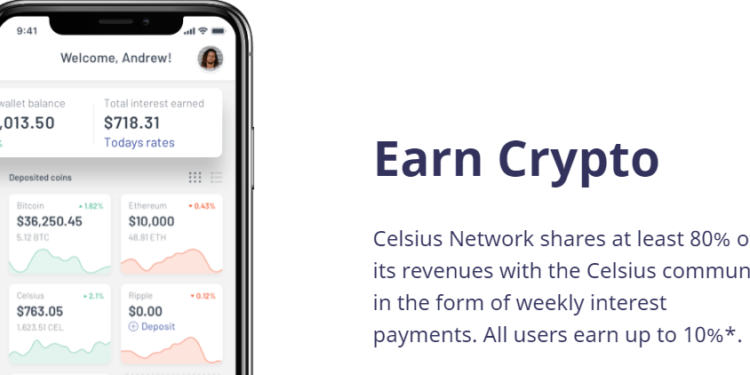

It didn’t take long for the prediction to manifest in the real world so according to the documents from the court case, the lawyers argued that most of the funds of the users were reposited on the platform at Celsius’ disposal and not the users’. in the retail section of the Celsius business operations, three key segments were identified, the Borrow Program, Earn Program, and the Custody program. The last one is the only section where the deposited funds are declared and under the purview of the user that made the deposit.

Unfortunately for the Celsius users, the custody section accounted for 4% of the deposits on the platform. The lion’s share was made in the Earn program and accounted for 77% of the deposits. However, under the Terms of Use of the platform, the title to coins is transferred to Celsius, and Celsius is entitled to use, sell, and pledge the coins. The underlying legal language was explained by David Silver who lambasted the platform’s defense and the hesitation to define itself as a type of financial entity or other.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post