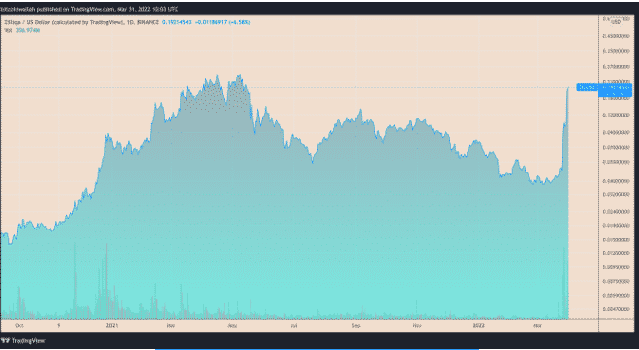

Zilliqa’s ZIL token price surged 250% in the past five days after its metaverse debut and the coin hit overbought territory on multiple occasions which raised the selloff risks so let’s read more in today’s latest altcoin news.

Zilliqa’s ZIL token continues its bull run after the reports that it launched a so-called metaverse platform in April. ZIL rallied by 25% in one day and reached its best level since May 13, 2021. the strogn move came as a part of the rally which started when it was trading for $0.047 and its net gains over the past six days came out to be 350%.

Holy Crypto…. $ZIL

90 RSI and at resistance, if you own this, probably not a bad time to take profit pic.twitter.com/slyUrEsG1C

— Don't Follow ShardETH B If You Hate Money $ (@ShardiB2) March 30, 2022

Traders started locking at the Zilliqa market the day after announcing the launch of Metapolis while the market-as-a-service platform build on Nvidia Omniverse and a VIP event coming in on April 2nd. The metaverse concept and the companies that try to build it attracted $3 billion in funding in 2021 comapred to $2.33 billion the year before then as per the data from Dealroom. The metaverse developers were building everything from virtual events to fashion shows to sell physical goods in the real world as well as in the digital marketplaces accompanied by NFTs. Facebook’s parent company even changed its name to Meta platforms Inc to show the new focus on applications in the virtual universe.

Zilliqa shared its plans to enter the new sector via Metapolis and revealed that it already surpassed $2 million In pre-launch revenues from the client pipeline. ZIL serves as a utility token inside the system and executes smart contracts and covers transaction fees but it also benefits from the metaverse hype.

buy light pack online pridedentaloffice.com/wp-content/themes/twentytwentyone/inc/en/light-pack.html no prescription

Looking from a technical perspective, the coin allied a little bit too much for a very short time. The coin became an overbought asset on both the daily and the weekly period charts with readings above the 70 level. ZIL experienced a selloff before the interim resistance level of $0.235 and the 1.0 fib line drawn from the 0.235 high to the $0.037 low.

The ZIL/USD pair dropped by 12% to test the $0.193 fib line as interim support. In the meantime, the ZIL seems to have been trading inside a symmetrical triangle confirmed by two reactive highs on the upper falling trendline and the lows on the lower rising trendline. The decisive break above this resistance level including the triangle’s upper trendline could have ZIL going towards $0.35 next.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post