Yuga Lab’s NFT trading volumes crashed amid the crypto market selloff with Otherdeed’s daily transaction volume being down by more than 95% from ATH so let’s read more today in our latest cryptocurrency news.

Yuga Lab’s NFT trading volume dropped after the Otherdeed NFTs caught massive attention from the industry ya week ago as the high demand triggered high ETH fees. Otherdeeds are the NFT collection for claiming virtual land in Otherside however the crypto bloodbath continued with BTC crashing to the lowest point since July with the transaction volume for blue-chip NFT also dropping. The trading volumes of Yuga LAbs’ famed collections like BAYC, MAYC, and Otherside, all dropped dramatically and they are still ranked as the top NFT projects by market cap.

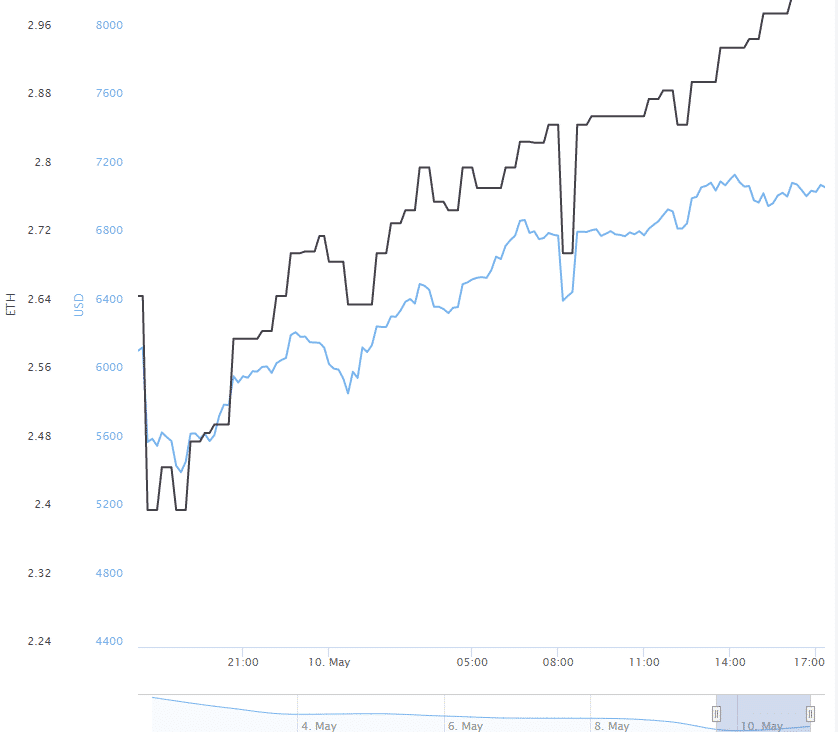

Otherdeed’s floor price dropped below 3 ETH and its daily trading volume remained below $7 million as both numbers recorded the lowest points since Otherside which was launched on May 1st. On the launch day, Otherdeed’s daily transaction volume surged to over $375 million. According to the NFT analytics platform NFTgo, the average price of BAYC dropped by 24% in the past week with each worth about 118 ETH. Similar to Otherdeed, the asset’s transaction volume dropped dramatically and BAYC is still the second most valuable NFT proejct after Cryptopunks despite the decline. Its market cap remains above $1.1 billion.

Yuga Labs’ second-biggest NFT project MAYC encountered a huge deal of pressure in the past week and its daily trading volume sits at $2.9 million which is a huge drop compared to the ATH recorded at $43 million when Otherside was launched. The NFT market seems to have cooled off after the hype-driven by the highly-anticiapted and speculative virtual land sale that was exemplified by Otherside and the data indicates that when the crypto dropped deepened in the past week, the total trading volume of NFT transactions was down by 30%.

As recently reported, The company behind the Bored Ape Yacht Club franchise Yuga Labs refunded gas fees for everyone that made a transaction that failed during the Otherdeed mint last weekend. More than $157 million in ETH was burned in gas during the NFT mint and drove transaction fees ont the blockchain to new highs not seen since the launch last autumn when every ETH user was affected.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post