YFI soars 30% after Yearn Finance announced an aggressive buy-back program that saw the price of the token skyrocket so let’s find out more in today’s altcoin news.

Yearn Finance is a decentralized finance protocol that announced it will be buying back its native YFI token and in the return, YFI soars 30%. In a tweet, Yearn Finance revealed that they would purchase $7,526,343 worth of YFI from the open market at a price of $26,651. Yearn purchased a huge chunk of YFI from the open market but more YFI has been bought back in the past month over the year. The team also revealed that the platform’s treasury has more than $45 million saved up with earnings stronger than ever which is why we should expect even more aggressive buybacks.

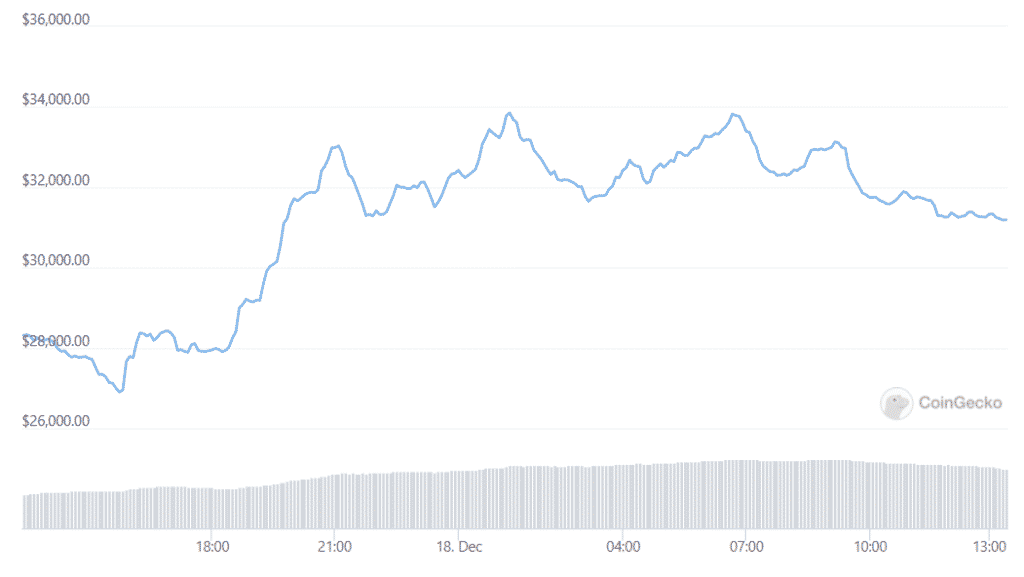

In a separate Twitter thread, analyst Adam Cochran talked some more about the plan and outlined other initiatives that Yearn is working on like revised tokenomics in order to a fee distribution to holders that are looking at a veCRV model and xSushi models. All this seems to have a huge impact on the price of the token. At the time of writing, YFI trades at around $27,000 while a few days ago it dipped to around $19,000. This portrays an increase of about 41% in the past three days with only 30% coming in the past 24 hours alone.

As previously reported, Yearn Finance is a popular decentralized finance protocol on Ethereum which bought back about $1 million of YFI tokens back during the spring in its buy-back program. Yearn Finance bought back about $1 million YFI as a result of a proposal called YIP-56 which aims to bring more value to the ecosystem by using YFI staking rewards to buy back YFI on the open market. Initially, the holders could not vote for new proposals but also stake their tokens and earn more yields from them.

Yearn Finance merged with the popular market coverage provider Cover and finished a busy week for the decentralized finance protocol. Cronje said that Cover will now become the main coverage provider for Yearn and for DeFi overall. Cover will be able to expand into a new cover money market and will make the CLAIM token collateral and a borrowable asset as well. For the part, Yearn will get coverage for the value and is able to offer the users a reduced risk product. Yearn Finance merges with Cover and the latest collaboration came naturally for both parties according to Cronje.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post