YFI resumes the downtrend after it got rejected at the $20,000 price level because of the immense volatility over the past few days so let’s read more in our latest altcoin news today.

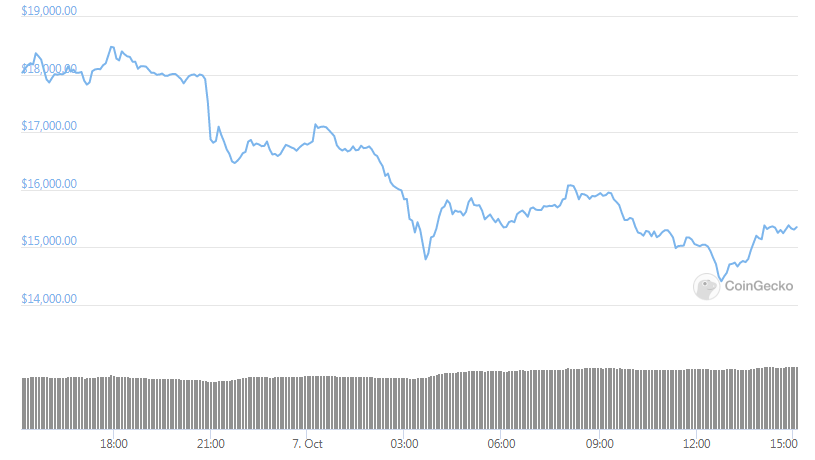

Multiple different factors are playing a key role in this movement including the community drama with the weakness across the aggregated DeFi sector. The catalyzed selloff which sent the Defi giant down to lows of $16,000 earlier this week, came in the form of a violent drop that was followed by a sharp “v-shape” recovery to more than $20,000. The recovery was short-lived but now YFI resumes downtrend path as the entire market sees increased weakness. Analysts are now noting that more downsides could be imminent in the near term which could lead it lower than $15,000.

This could be the start of the deeper correction trend as traders are pointing out to the formation of a bear-favoring top. At the time of writing, Yearn.Finance is trading down at more than 3 percent with a price of $18,000. This marked a notable drop from the daily highs of ,000 that were tapped shortly around this time yesterday.

buy propecia online blackmenheal.org/wp-content/themes/twentytwentytwo/inc/patterns/en/propecia.html no prescription

The cryptocurrency hit the highs after rebounding from $16,000 so whether or not it will be able to continue higher, it will depend on the ability of the bulls to keep the support at $16,000.

If broken below, the coin could start a huge descent which will bring the coin down to lower levels below $15,000. Although the price is sliding lower, yearn. finance’s ecosystem is getting stronger and its underlying value could outpace the one of YFI’s price. Because YFI is seen as an index bet on the Defi space, if it rallies higher or not, could depend on the performance of the entire sector. While speaking about the mid-term structure of the cryptocurrency, one trader observed that YFI formed a triple top pattern which represents a macro high for an asset usually:

“Looks like he wants to come back down… pamps postponed till further notice.”

As it can be seen in the charts, it seems that the trader was targeting another move towards $15,000 price range.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post