YFI nosedives by 17% over the past 24 hours, facing a strong rejection which makes it the worst performer in the top 100 cryptocurrencies. YFI underperformed Bitcoin’s 0.5% gains in the past day as we are reading today in our altcoin news.

Yearn.finance faced a strong rejection and YFI nosedives by 17% in the past 24hours. The drop in the coin came during the strong drop in the yields of the users of the Vault products. The yields are responsible for the drop as high yields allow them to obtain even more fees from the users’ deposits. Yearn.Finance faced a strong rejection over the past 24hours and the leading crypto-based on-Ethereum is now the worst performer among the top 100 cryptocurrencies. While YFI could be under pressure in the short-term, the analysts are optimistic about the project’s long-term prospects.

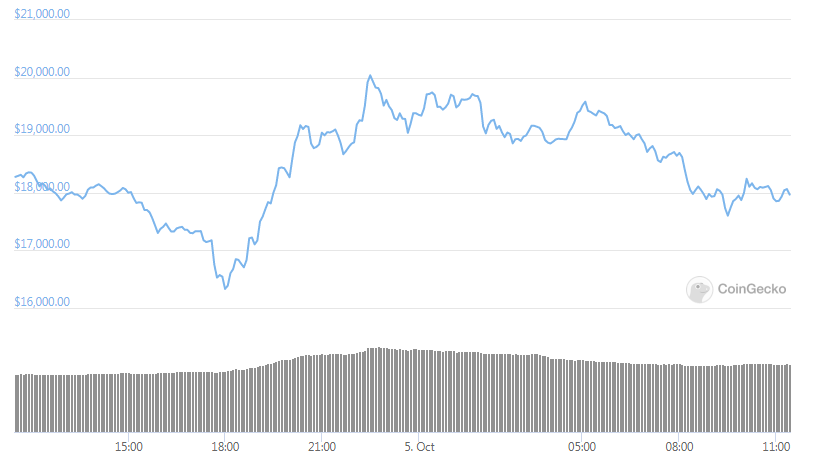

Yearn.Finance got down by 17% over the past 24 hours with the price of the leading DeFi coin reaching $17,000 for the first time in a few weeks. In fact, the coin is now trading at lows not seen since the end of August which is a few days before the strong September correction. YFI’s performance makes it the worst performer in the top 10 cryptocurrencies. The coin is one of the Defi coins that crashed lower in the day as SushiSwap declined by 13% while UMA, BAND, UNI, and others dropped between 5-10 percent in the past day.

Analysts remain optimistic about the long-term prospects despite the harrowing price performance. Lou Kerner, the partner at CryptoOracle commented:

“Yearn is so impressive because it takes the massive opportunity and remarkable complexity of DeFi, makes it simple to use, while deeply integrating with leading DeFi protocols (e.g. Uniswap & Curve), and leveraging community as a powerful moat.”

The optimism was echoed by others like Andrew Kang of Mechanism Capital and the crypto fund even released a report in which it determined that in the long run, YFI could end up trading at a price of a higher magnitude than right now:

“Our bullish DCF case yields prices of $241k and $315k, depending on whether a performance fee is applied to yToken revenue. A TVL of over $150 billion by the end of 2024 is certainly aggressive — that’s almost 3x the current market cap of ETH! — but given the growth of stablecoins & vaults that we have already witnessed and the fact that we have only implemented a fraction of potential strategies that are planned we do not believe that this scenario is out of the question. We also don’t want to forget that tokenized real world assets are beginning to enter DeFi.”

Kang elaborated further that Yearn.Finance’s utilization of other yield-farming strategies will boost the protocol revenue higher.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post