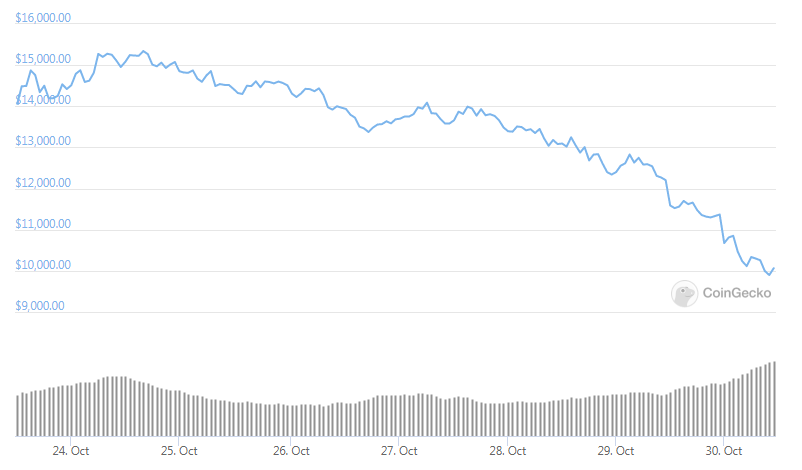

YFI keeps on crashing but there is a new proposal that could save it from more price declines. Yearn.Finance’s token was caught in a brutal downtrend even since the price hit $45,000 with the bears now trying to push it below $10,000 as they continue gaining control over the macro outlook so let’s read more in today’s altcoin news.

The drop seen as of late has struck a major blow to the long-term trend and it has damaged the community sentiment and opened the gates for even more downsides. The analysts noted that there’s a drop below $10,000 in the cards and it could come quite soon if the bulls cannot take control of the price action. With all that being said, a new proposal could save the coin from dropping.

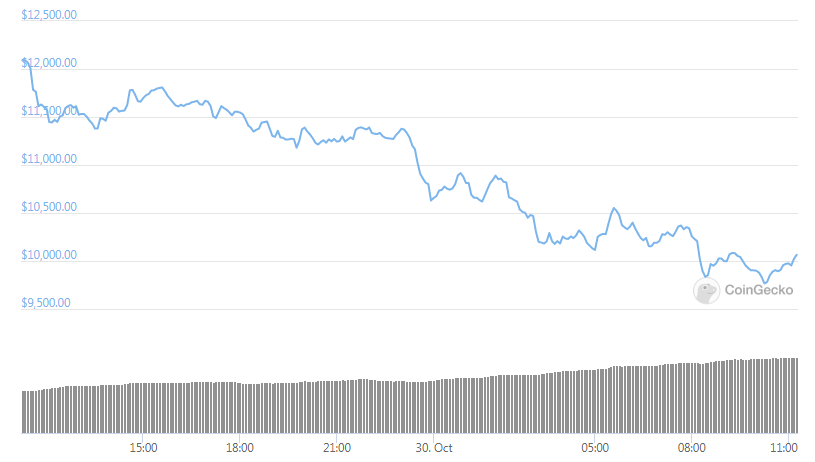

The proposal named “Rethinking Capital Allocation” suggests that the income of YFI should no longer be distributed to stakers but it could be used to buyback YFI tokens on the open market. this will provide a constant stream of buying pressure on the token and it could help to stop the downtrend and give it some momentum. Since August, the protocol generated about $2 million in fees which means that if passed, this proposal could create about $1 million per month in buy-side pressure. At the time of writing, the YFI token is trading about 6% at the current price of $11,700 which is the lowest price it has been since the peak of $45,000 a few months back.

The selling pressure seen as of late was relentless with the bears fading every attempt in upside movement as they continue targeting a drop into the $10,000 region. This has struck a major blow to Yearn. Finance and its technical outlook and have further fractured the fragile community. One of the few catalysts for the near-term to the upside is the governance proposal that suggests fees from the ecosystem should be redirected from the stakers and towards the market buying tokens. This will disincentivize staking in the short-term but it could also help slow down the token’s descent. Ryan Watkins from Messari spoke about this in a tweet:

“Rather than distributing income to YFI stakers now, Yearn should use income to buy back YFI to reinvest in growth. The goal is to maximize long-term value creation for YFI stakeholders.”

It’s also important to note that he stated that the goal of this is not to prop up the price but to use the already accumulated tokens and incentivize community activism and creation. With that being said, the buy-side pressure could create a positive impact on the token.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post