YFI incited a massive selloff recently as it was caught in an intense downtrend over the past week which was initiated due to various factors as we are reading more in our latest cryptonews.

The weakness seen over the aggregated DeFi sector contributed to the decline of the YFI governance token but it now seems to have been sparked by the controversies around the project that the YFI founder has created, named Eminence. After multiple teasers, Yearn.Finance’s creator Andre Cronje informed the savvy crypto users that he found the token contract and started depositing DAI in order to manually mint the EMN token. Due to a lethal bug in the contract the user was able to pull out the deposited DAI which left the investors with nothing.

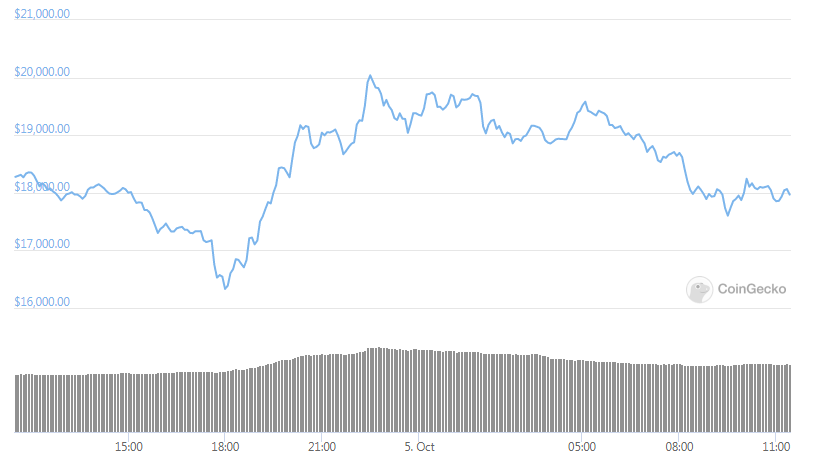

This created animosity towards the founder of the token, despite the contract still being in its early stages of development. the YFI price was dropping lower after this drama occurred and one analyst even noted that it could see another correction which will send it below $10,000 over the weeks and months ahead. At the time of writing, YFI incited a massive selloff, trading at 10% with a current price of $17,000. This is the lowest level for the coin since the peak of $40,000. The intensity of the selloff was quite severe and was compounded by the massive inflows of the sell-side pressure for the perpetual swaps on different platforms.

As seen with some other tokens, the confluence of sport selling pressure and the increasing short positions can be quite lethal for the coin which could also lead to further near-term downsides. YFI’s price dipped below $16,100 today before it found support that slowed down its drop. While speaking about where will the coin look for a new trend, one analyst explained that the $10,000 level is the next key support level to watch while also noting that a break below this level will lead to a decline at $6,000:

“Not a good look for YFI. Target at least $10k range, but horizontal support down there is at $6k.”

If this intensity of the decline happens, it could create more headwinds that will slow down the growth of the entire Defi sector. This will have far-reaching impacts that will even impact Ethereum and other major altcoins as well.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post