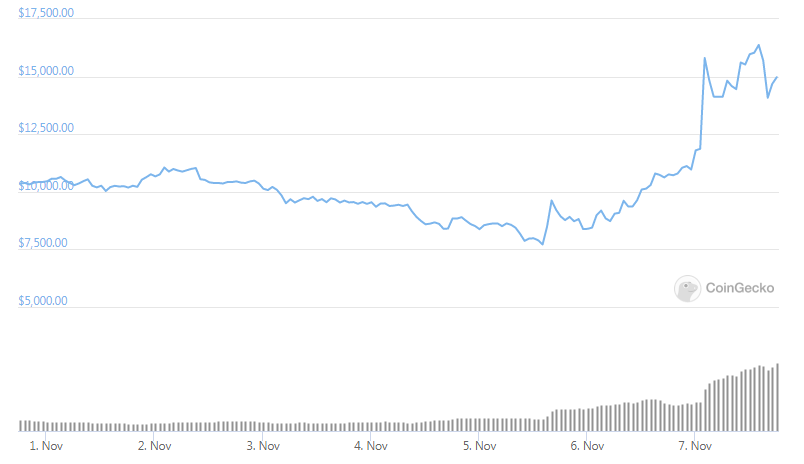

YFI goes parabolic as it increased by 100% in a time span of 36 hours, after the massive short squeeze happened, as reported earlier in our altcoin news.

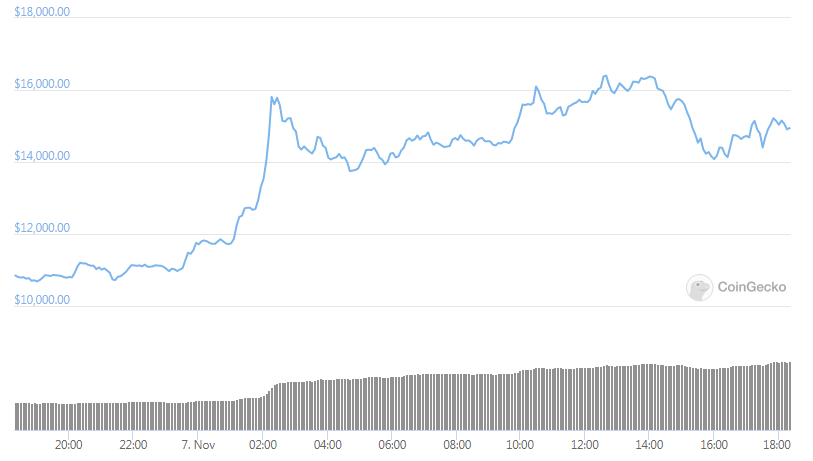

The coin is up by 100% in the span of 36 hours after falling to $7500 on Thursday morning. YFI is now trading for $16,200 on leading futures exchanges but it peaked as high as $18,000 minutes ago. YFI’s rally has allowed the cryptocurrency to reclaim its seat among the biggest 50 cryptocurrencies by market cap.

While YFI is exploding higher, the coin didn’t overextend as per futures data. The funding rate of the YFI futures market on Binance is now at 0.01% which is a baseline level. the funding rate is the fee that long positions pay short positions on a regular basis to keep the price of the futures close on the spot market. YFI could be overextended from a technical perspective as all of its momentum indicators are at all-time highs, suggesting that the coin could be overbought in the near-term.

YFI goes parabolic after increasing by 100% but let’s check its movement over the past few days. The cryptocurrency reeled as low as $7500 earlier today where the bulls stepped up and sent it surging to new highs of $10,000. It did face a huge influx of selling pressure at this price with the buyers unable to flip this historically significant level.

buy viagra capsules generic buy viagra capsules online no prescription

If this level gets broken above and confirmed as support of $10,000 it could eventually act as a strong base for growth that could send it flying much higher. Despite the strength today, YFI had a disastrous performance as one economist pinpointed the weakness of the Yearn.finance ecosystem’s founder.

Yearn finance trader says YFI could see more short squeeze to $14,000 as it broke below $9000 as sellers stay in full control of the near-term outlook while still erasing the gains that it incurred as a result from the parabolic rally. This weakness came about due to many factors like the fragmented community, low yields on the ecosystems’ products, and the focus on new tokens that he is working on. The weakness came due to the bullish governance proposal that redirects the ecosystem’s income away from staking rewards and to the market buying YFI tokens. This could provide it with even more buy-side pressure but remains unclear whether this will be great for stopping the descent that the coin is now facing.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post