YFI expects huge trouble ahead as the asset has not stopped falling for the past six days and also fell from its all-time high above $44,000 as we are reading more in the latest altcoin news.

The Yearn.finance governance token remained among the best-performing crypto-assets in 2020 with huge gains near 2000 percent. Its higher-than-expected price which reduced its bids in the open market. That has resulted in a sharper decline as well and now YFI expects huge trouble ahead.

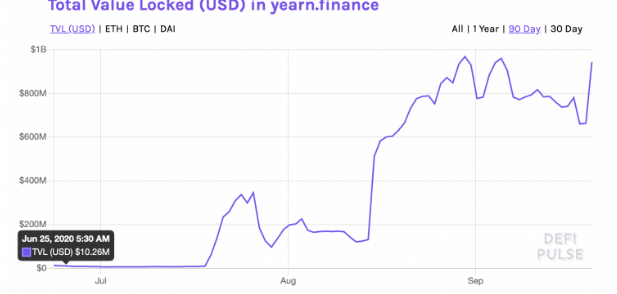

The YFI/USD dropped another 15 percent marking a $22,495 as its intraday low which brought the pair down by almost 48% from the all-time high. At the same time, the total value locked inside the pool of YFI moved to the $950 million and it is now on the verge of reaching a record level. The ballooning liquidity pool and the dropping prices expressed a major conflict between YFI’s fundamental and technical proponents. The $950 million worth of capital reserves shows that the users were choosing the coin for the leading aggregator services and the demand for the product also failed to excite the traders with the increasing exposure in the coin.

Part of the reason could be the underperforming YFI sector as well. Yearn.finacne aggregated lending services such as Fulcrum, DyDx, Aave, Compound to find the best yield for the users. Once a user deposits the tokens into the yearn.finance pool they will receive tokens in return. In the meantime, people that can provide a certain amount of the tokens back to yearn finance will receive YFI which is a cryptocurrency that gives the users the right to make changes in the protocol via voting and proposals.

The demand of YFI depends on the token liquidity so it seems that not many tokens holders are demanding YFI. Sam Bankman Fried, the CEO of FTX explained:

“On the one hand, I think people don’t realize that while YFI itself isn’t yield farming, it’s revenue comes from yield farming, so it’s still really tied to it. So it crashes with farming.”

The analyst added that he remained long-term bullish for YFI because its creator Andre Cronje is still building applications around it:

“So though I’m bearish on YFI as it exists right now, YFI might become something much more powerful over time.”

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post