YFI becomes the youngest DeFi billionaire as the token is growing with a supersonic speed with no signs of slowing down. Following our latest altcoin news today, we can see that Yearn.Finance joins Maker, Curve, Aave and Compound as DeFi protocol with $1 billion of assets locked in smart contracts.

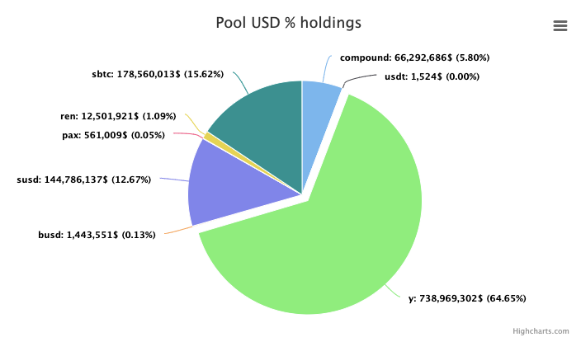

YFI becomes the youngest DeFi billionaire after it doubled its market cap from two weeks ago. The Yearn.finance protocol has been on a rampage ever since the creator Andre Cronje announced his return to the decentralized finance space. The commencement of the liquidity mining program of Curve last week was a turning point for yEarn whose liquidity pool yCRV accounted for 65% of the Curve liquidity.

yEarn Vaults are automated investment strategies that also have been accruing more deposits thanks to the industry-leading return of investment. The protocol is possibly the fastest-growing DeFi product at the moment and there are no signs of slowing down. YFI, the native governance token of Yearn.finance, is one of the few tokens whose intrinsic value is correlated to a total value locked. The TVL explosion has caused a huge jump in revenue from fees to the holders. The token increased by 185% this week and 1615% over the past month hitting $15,590 yesterday.

Yearn.Finance launched its governance token back in July and the altcoin has been shooting up since. It debuted on the market at a low of $31.65 but the price shortly increased over 34,364%. The so-called “valueless” governance token increased recently to a previous all-time high of nearly $11,275 but the different technical indexes suggest that the altcoin is about to retrace. Over the past few weeks, the YFI community members were driven by the price surge of the asset and the hopes to hit new highs came true after the coin surged to new highs of $12,000 before facing a huge influx of selling pressure that caused it to dip as low as $9000.

Also, The top DeFi token YFI has crashed by 20% after the long parabolic run over the past few weeks. The Ethereum-based asset traded at $4,200 a week ago and yesterday it hit $16,500 which is a gain of more than 300% in seven days. In the past 24hours, YFI dropped by 20% and is now trading at $12,000 which is $4500 lower than the highs seen on Thursday.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post