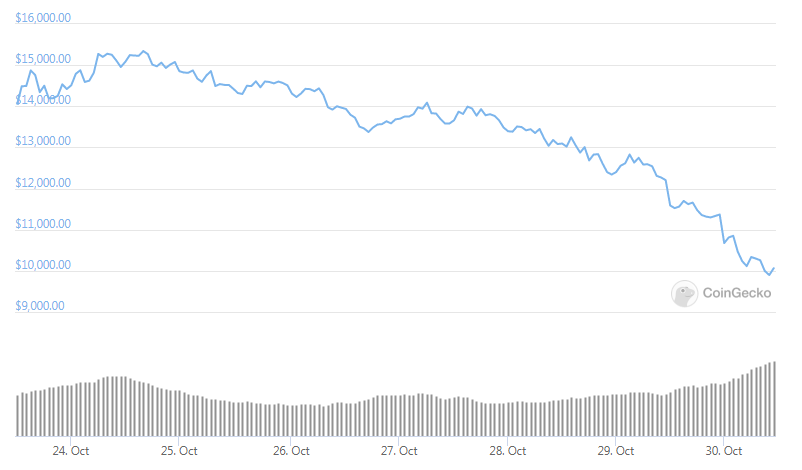

Yearn.finance plunges towards $10,000 again despite the recent 20% relief rally after the coin underwent a strong bounce back on Friday and the coin hit multi-week lows of $9800 so let’s read more in today’s altcoin news.

The cryptocurrency surged around 20% from $9800 to $11,900 in about eight hours. However, unfortunately for the buyers, it continued to slide below. Yearn.Finance plunges towards $10,000 as the token failed to hold the aforementioned highs despite the strength in Bitcoin. YFI is now trading for $10,500 which is a drop of 10% from the local highs of $11,900. The market data suggested that this continued sell-off is a byproduct of the futures short-selling. Andrew Kang from Mechanism Capital shared a tweet noting that the recent downtrend of the governance token has been predicted on the open interest on Binance’s YFI futures market rising. This only shows that the investors will be shorting the asset which will result in downward price action.

OI on $YFI at new ATHs, surpassing first capitulation at 12k earlier this month

12k-15k liquidity capitulated into high volume at 10ks (same as first capitulation into 12ks

Sell side orderbooks thin

What happens to shorts on a bounce up? pic.twitter.com/Bc03Vhm2Cn

— Andrew Kang (@Rewkang) October 30, 2020

There were a number of transactions spotted by the investors where the early YFI adopters deposited huge sums of cryptocurrency into Binance. it is believed that these coins were sold for fiat and resulted in some of the downward price action that we can see now. The drop in price for the YFI coin came in the face of a positive fundamental trend as the yields offered by the protocol’s Vault products started to move higher as fresh strategies were activated. Yearn.Finance developers are expected to roll out Vaults V2 shortly which is expected to improve the performance of the protocol and the fees accrued to the YFI holders.

While YFI could have fundamentals going for it, there could not be enough to stop the cryptocurrency from underperforming similarly to Bitcoin. Su Zhu, the CEO of Three Arrows Capital stated that BTC is rallying rapidly and will automatically compress the altcoin returns:

$BTC going up swiftly is not only not bullish for alts but it’s bearish. Reasons for this are myriad but boil down to the fact that money is a coordination game and Bitcoin is the Schelling point; this is independent of how you feel about it, community is literally irrelevant.”

Qiao Wang, the popular analyst, stated that he will not be surprised to see DeFi coins like Yearn.Finance’s YFI drops further from here.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post